Essential Product Industries Drive Job Announcements to Record High Part 2

In part one of this two-part series, I discuss how the geopolitical forces of the Russian invasion of Ukraine, domestic supply chain growth for clean energy, essential products revealed by the COVID-19 pandemic, and the risk of China decoupling accelerated the already growing trends of reshoring and FDI (foreign direct investment). In part two, I discuss the reshoring decision shift based on “doing the math” with TCO (total cost of ownership). I also look at workforce development and future projections.

Total Cost of Ownership (TCO) impact - recognizing the overall feasibility of reshoring and identifying the best-suited products

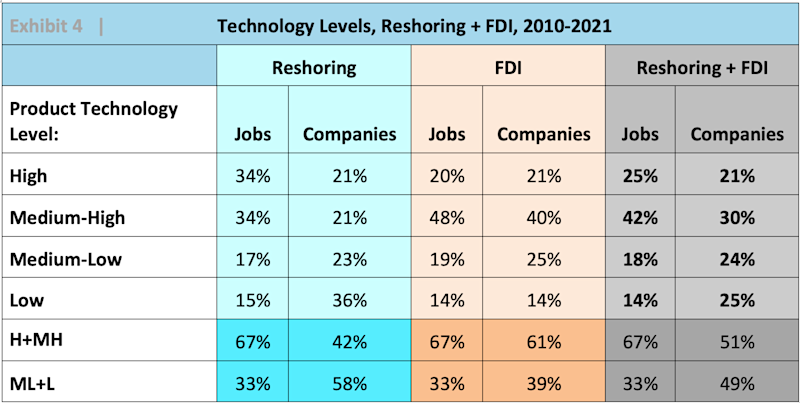

About 60% of companies decide to offshore based on wage rates, free on board (FOB) prices, or landed costs. Much of the strength of the reshoring trend can be attributed to more companies becoming familiar with a broad range of factors (costs and risks) they previously ignored. This change in behavior is partially due to the recent dramatic increase in those costs and risks.

Understanding the reasons other companies give for reshoring helps companies to determine whether those reasons apply to them. A broad range of costs and risks can be quantified using the online Total Cost of Ownership Estimator. The Impact of Using TCO shows that shifting decisions from a price basis to TCO can be expected to drive reshoring of 20% to 30% of what is now imported. In Exhibit 3, the percentage of work that is more profitably sourced domestically rather than imported from China rises from 8% to 32% when the sourcing metric shifts from FOB price to TCO. For products subject to 15% Section 301 tariffs, the percentage rises to 46%.

Exhibit 3 | Chinese Price & TCO As A Percentage of U.S. Price & TCO

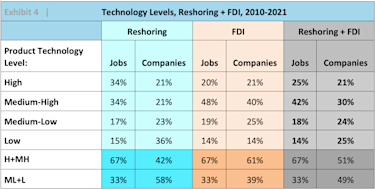

Trend towards high tech products

Reshoring and FDI continue to add more high-tech jobs than low-tech, again driven by the essential products push. This trend is important since the U.S. has a trade deficit in high-tech products. Reshoring is stronger in high-tech than FDI, which is stronger in medium-high-tech due to the high percentage of transportation equipment in FDI. The higher tech companies average more employees per company than do the lower tech companies. I think the U.S. needs to be competitive on all tech levels to balance the trade deficit and employ a broader range of workers. One challenge is to upskill our workforce to work on more highly automated production of lower tech products.

Future projections

Based on the first quarter of 2022, I project that 2022 reshoring and FDI jobs announced will be upwards of 400,000. However, at some point, companies will become more focused on fulfilling the giant commitments already made before announcing more. We anticipate the strength of reshoring vs. FDI to continue, consistent with a multi-year slowing in global FDI. The COVID-19 pandemic and geo-politically induced business disruption and uncertainty is causing companies to emphasize operations in their home countries.

Survey results showed a surge in reshoring plans in 2021, subject to the emotion of the pandemic, and have continued in 2022. Fictiv's 2022 State of Manufacturing Report revealed that 65% of U.S. manufacturing companies want to increase reshoring due to continued supply chain disruptions.

Training a skilled workforce to fill the new positions will be a challenge and barrier to further growth. To meet this challenge, companies, trade associations, and states have been ramping up training programs. Perceptions of manufacturing jobs are also improving. According to a Deloitte study, there are “big gains in perceptions of US manufacturing as innovative, critical, and high tech.”

A recent study of 18-24 year olds, found that 56% have changed their views on manufacturing due to the COVID-19 pandemic. Of the 56%, 77% said they now view manufacturing as more important than they did pre-pandemic.U.S. manufacturers now have an opportunity to leverage positive public perception and attract more recruits. Public recognition of the strength of the reshoring trend helps to further improve the image of manufacturing as a good career.

Reshoring Initiative 2021 Data Report

The full Reshoring Initiative 2021 Data Report: Essential Product Industries Drive Job Announcements to Record High offers detailed analysis of data on jobs, companies, industry, and countries from which reshoring originates and states to which it returns.

Are you thinking about reshoring?

Look for me and The Onshoring Project (TOP) at IMTS 2022 where we look forward to discussing reshoring successes and opportunities with you. Visit the TOP booth near Gardner Business Media at the entrance to the North Hall, and mark your calendars the IMTS Smarter Sourcing Symposium at 8:30 a.m. on Friday, September 16, in Room S-100.