The 2025 USA Reshoring Survey, conducted among 500 U.S. manufacturers in collaboration with the Reshoring Initiative and Regions Recruiting, aimed to derive three key insights. First, to determine the strategy or the “why” driving OEMs (original equipment manufacturers) to reshore; second, to understand the points of view from the contract manufacturers’ (CMs) perspectives; and third, to grasp a comprehensive understanding of the actions needed to increase the rate of reshoring. The conclusion: A sufficient quantity and quality of U.S. workforce would bring back more manufacturing than any other option surveyed, including tariffs, a lower U.S. dollar, lower tax rates, and fewer regulations.

The survey also revealed the strategic imperatives necessary for U.S. reindustrialization:

Level the cost playing field

Develop or grow a larger, skilled workforce

Apply total cost of ownership (TCO) principles

Prepare for geopolitical risk

Let’s dig into the details of the OEMs’ response.

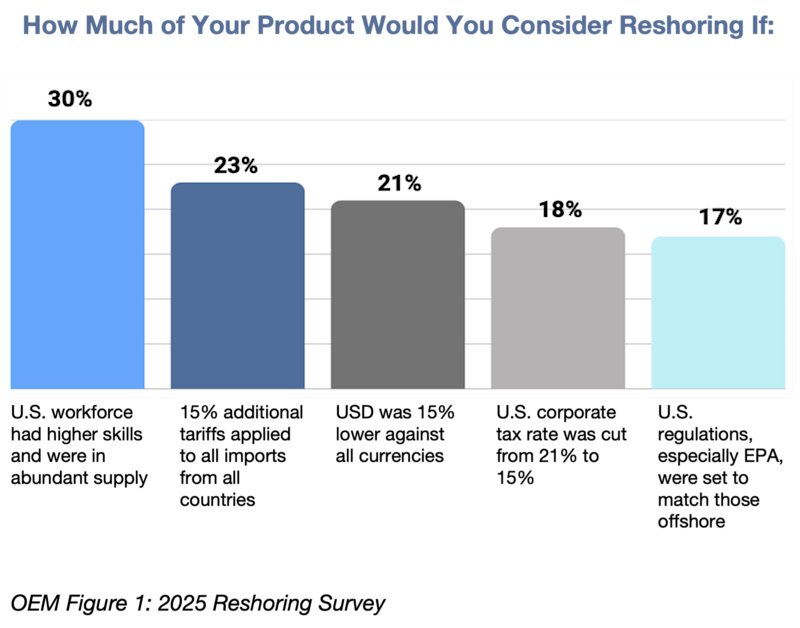

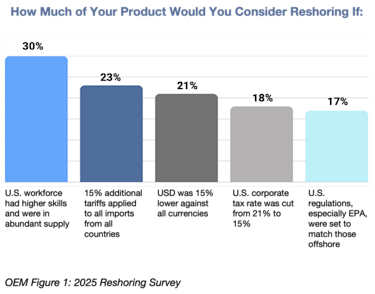

The Chief Catalyst for Increased Reshoring

The primary driver for increasing reshoring is a larger, stronger, and more skilled U.S. workforce. Given that resource, OEMs would reshore 30% of their products currently offshored. If a 15% tariff were applied to all imports from all countries, OEMs would reshore 23% of what they currently produce offshore. This was followed by a 15% reduction in the value of the U.S. dollar (21%), corporate tax rate cuts from 21% to 15% (18%), and matching U.S. regulations with those offshore (17%).

A skilled manufacturing workforce is essential to any meaningful effort toward reindustrialization. Companies understand they need a larger workforce to increase output and better training to improve competitiveness.

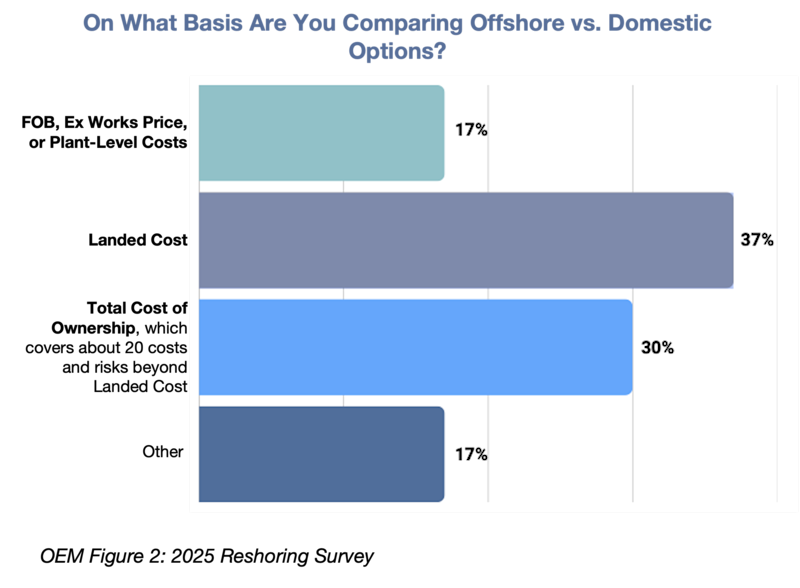

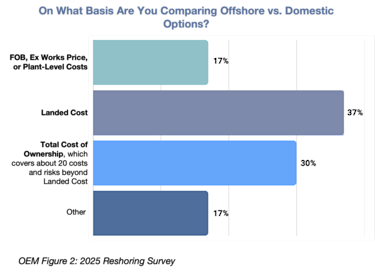

Shifting OEMs to TCO Would Reshore Billions of Dollars

Only 30% of OEMs use the total cost of ownership (TCO) in comparing domestic to offshore sourcing. Seventeen percent continue to use Ex Works or plant-level costing, and 37% rely on landed cost. Seventeen percent use some other form of costing for their suppliers.

These methods often underestimate actual offshoring costs by 20%-30%. On the other hand, the Reshoring Initiative’s TCO calculator and other external and internal business considerations can more accurately determine the true total cost of ownership.

Shifting most OEMs to a robust TCO system would reshore $200 billion of manufacturing with no government subsidies, no supply chain shock, no retaliation, and no impact on inflation after companies factored in all global risks and costs. By using TCO instead of less comprehensive measures of cost and risk, OEMs can increase profitability while benefiting all stakeholders. Data on 190 cases comparing China to the United States showed the U.S. win rate going from 8% based on price to 32% based on TCO.

Prepare for Geopolitical Risk

The U.S. manufacturing sector stands at a crossroads, facing decisions that will determine its future. The 2020 global pandemic and its aftershocks exposed vulnerabilities in the U.S. supply chain due to our $1.2 trillion goods trade deficit.

U.S. manufacturers are reevaluating sourcing strategies beyond low-cost countries and planning for supply chain risks that could cause long-term disruptions worse than those experienced during the pandemic. The survey results reveal that many manufacturers are considering the collaborative benefits of locating manufacturing near engineering and placing high value on the quicker delivery enabled by localization strategies.

The Strategic Benefit of Manufacturing’s Proximity to Engineering

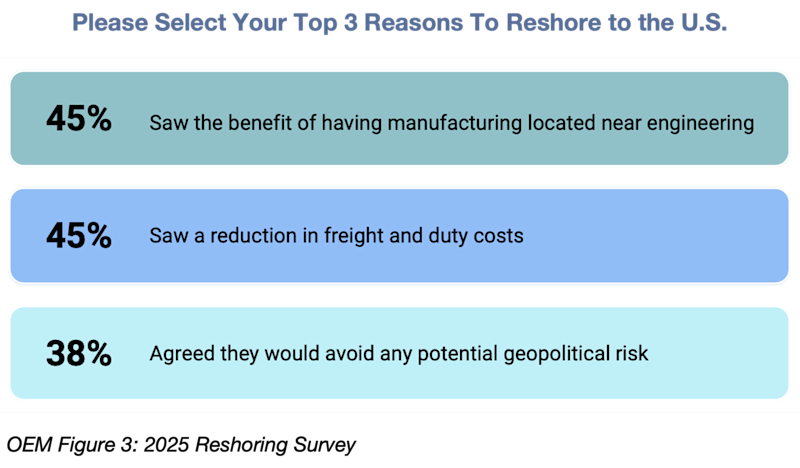

The top three reasons given for reshoring were locating manufacturing near engineering (45%), reducing freight and duty costs (45%), and avoiding geopolitical risk (38%). Proximity to customer markets was the next most cited reason for reshoring (35%).

Competitiveness: The Percentage Premium for a One-Week Delivery

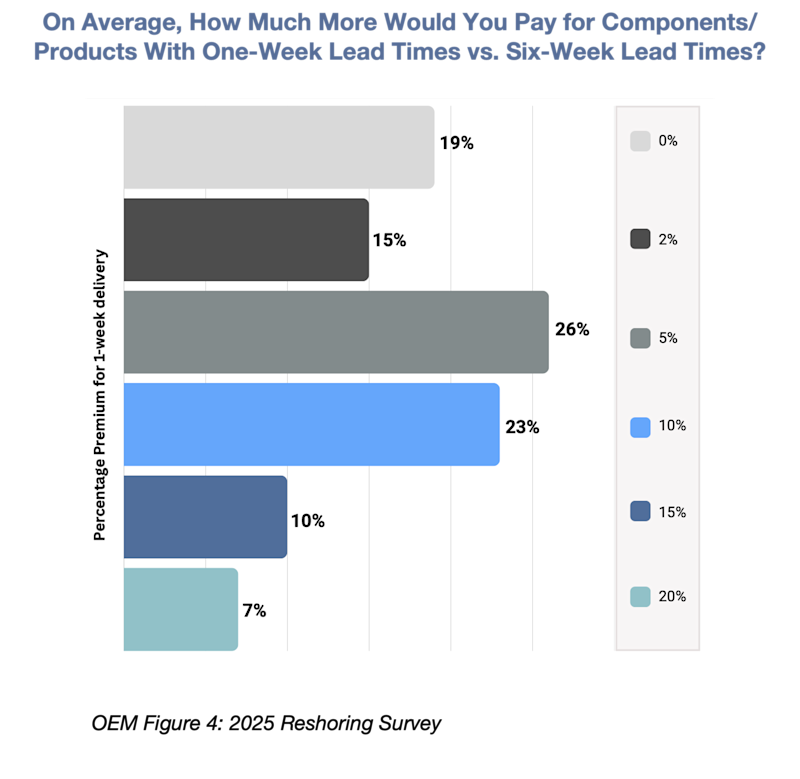

Forty percent of OEMs were willing to pay 10%-20% more for delivery that was five weeks faster. This premium for shorter lead times points to a great opportunity for CMs. Typical delivery time by surface freight from inland China/Asia to the Midwest is about six weeks. Nevertheless, some respondents lost business to imports based on delivery. Presumably, the benefit comes from much smaller inventories and better availability.

Insights From the AMT Reshoring Survey Subset

We compared the survey responses from IMTS exhibitors and AMT members with those from the full national survey. We examined this subgroup’s method for comparing offshore versus domestic options. Just 5% of the OEMs in this subgroup use TCO in their comparison, while 20% rely on Ex Works pricing or plant-level costing, 50% turn to landed cost, and 25% use some other form of costing for their purchases. This indicates that if the companies in the AMT and IMTS subgroup revise their costing strategy to adopt the more accurate TCO approach, they would realize significant benefits of reshoring, such as driving profitability without government subsidies, supply chain shocks, retaliation, or impacting inflation after companies factored in all global risks and costs.

We reviewed the top reasons this subset would reshore and found similar results to the national group: locating manufacturing near engineering (75%), reduced freight and duty costs (75%), and proximity to customers (50%). We conclude that the benefits of “local for local” are consistent, predictable, and positive.

Overall, the subgroup findings were consistent with the overall analysis.

Other Key Survey Findings

Details on these results are available in the full report:

95% of OEMs were fully or somewhat satisfied with the results of their reshoring.

The biggest sources of reshoring were China, followed by Southeast Asia.

31% of OEMs said their business would be severely or moderately negatively impacted if all immigrants lacking permanent legal status were deported.

32% of OEMs still plan to offshore, primarily due to cost and the availability of products or components.

Recommendations for Federal Policymakers

Investing in a stronger, skilled workforce is the single most effective lever for economic growth. The best way to promote more reshoring and protect the United States from increasing geopolitical risk is to implement an effective national industrial policy. Such a policy should focus on broadly leveling the cost playing field, ensuring a workforce of sufficient size and skill, reducing regulations, and maintaining a tax structure that allows for the immediate expensing of capital investments such as automation (now law under the One Big Beautiful Bill Act).

A lower U.S. dollar – reversing some or all of its overvaluation – is preferred because it reduces imports and increases exports. Tariffs reduce exports due to retaliation, which has been implemented or threatened since the spring of 2025.

Automation makes U.S. manufacturing more cost-competitive, enabling more reshoring and requiring still more automation, creating a virtuous cycle.

The Survey Identifies Three Key Federal Funding Areas

Survey data suggest several policies and areas for federal funding that could encourage reshoring and foreign direct investment:

The current state of the U.S. workforce is bottlenecking reshoring efforts. Policymakers should implement critical policies and funding to support workforce training for skilled workers, such as apprenticeships.

Reduce federal loans for students seeking degrees in oversupplied fields and shift resources to apprenticeship and trade school loans.

Create a Small Business Administration (SBA) investment loan guarantee conditional on workforce development.

More suggestions are available in the Reshoring Initiative’s Competitiveness Toolkit.

Are You Thinking About Reshoring?

We encourage companies to implement the top priorities for reindustrialization revealed by the survey – build a strong talent pipeline, use TCO, and prepare for geopolitical risk.

For help, contact me at 847-867-1144 or email me at harry.moser@reshorenow.org.

Have you reshored a metal component or product? Apply for the National Metalworking Reshoring Award today. Awards will be presented at FABTECH 2025 and IMTS 2026.

Read the full 2025 Reshoring Survey Report.

Actions You Can Take To Overcome the #1 Barrier to Reshoring: The Skilled Workforce

As manufacturing reshoring gains momentum across the United States, a new report – Mastering the Reshoring Boom: 5 Tips for Staffing Your New Facility – highlights critical strategies for flawless execution. All too often, senior leadership underestimates the capital requirements and training complexities involved in launching new facilities. The report emphasizes that factory startup execution extends beyond merely filling vacancies; it's about building high-performing teams capable of seamless integration, rapid technology adoption, and sustained productivity.

Here are five key tips from the report for manufacturers planning to staff new facilities:

Strategically Transfer Existing Personnel: Seed new facilities with experienced staff to embed company and product knowledge, and backfill their original positions with new hires.

Proactively Develop Your Workforce Through Targeted Apprenticeships and Partnerships: Actively cultivate a skilled talent pipeline to mitigate shortages and tailor training to specific operational needs.

Leverage Data-Driven Workforce Planning and Talent Mapping: Utilize analytics to accurately forecast skill demands, assess labor markets, and strategically plan for future talent needs.

Implement Robust Onboarding and Continuous Training Programs: Establish comprehensive programs that immerse new employees in company culture, safety protocols, and operational procedures, ensuring ongoing skill development.

Partner With Specialized Recruitment Experts for Strategic Hiring: Engage experts to reduce time to fill, improve candidate quality, and prevent costly delays.

For help, contact Kathy Nunnally at 404-636-2161 or knunnally@regionsrecruiting.com.

This article was written with Kathy Nunnally, President of Regions Recruiting.

The Reshoring Survey findings underscore that addressing the skilled labor shortage is the top priority for successful reindustrialization and reshoring in the United States. Without a robust, well-trained workforce, ambitious reshoring goals will face significant delays. The proactive measures by certain states and companies offer a blueprint, emphasizing the need for a more cohesive, national commitment to shifting mindsets and investing in comprehensive workforce development programs.

Click here to access the full article, “Priority #1: Manufacturing Workforce Development,” authored by Kathy Nunnally.

For expert guidance and support with talent strategies to advance your business, contact Kathy Nunnally, President of Regions Recruiting, at knunnally@regionsrecruiting.com, or call the office at 404-636-2161.