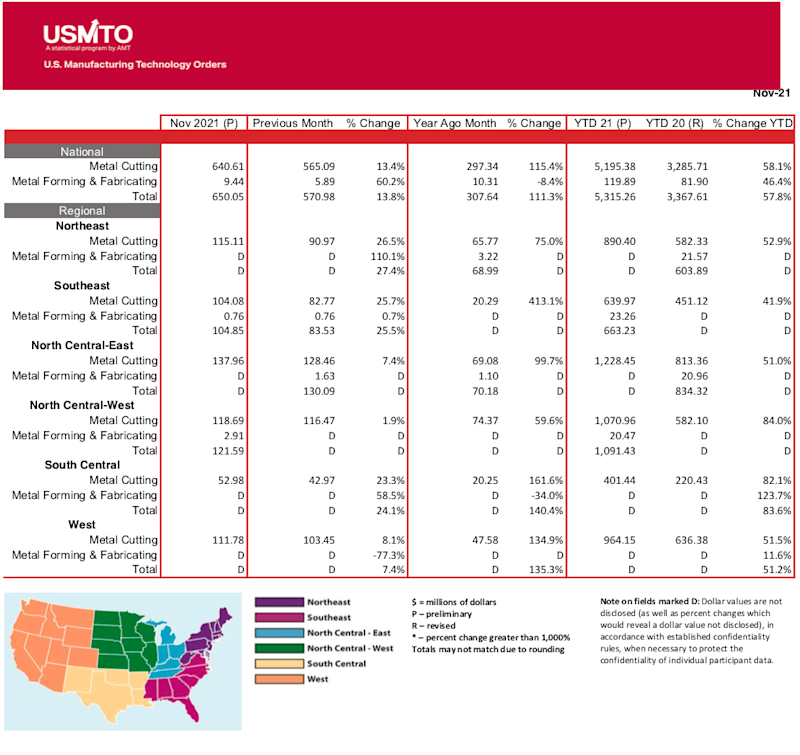

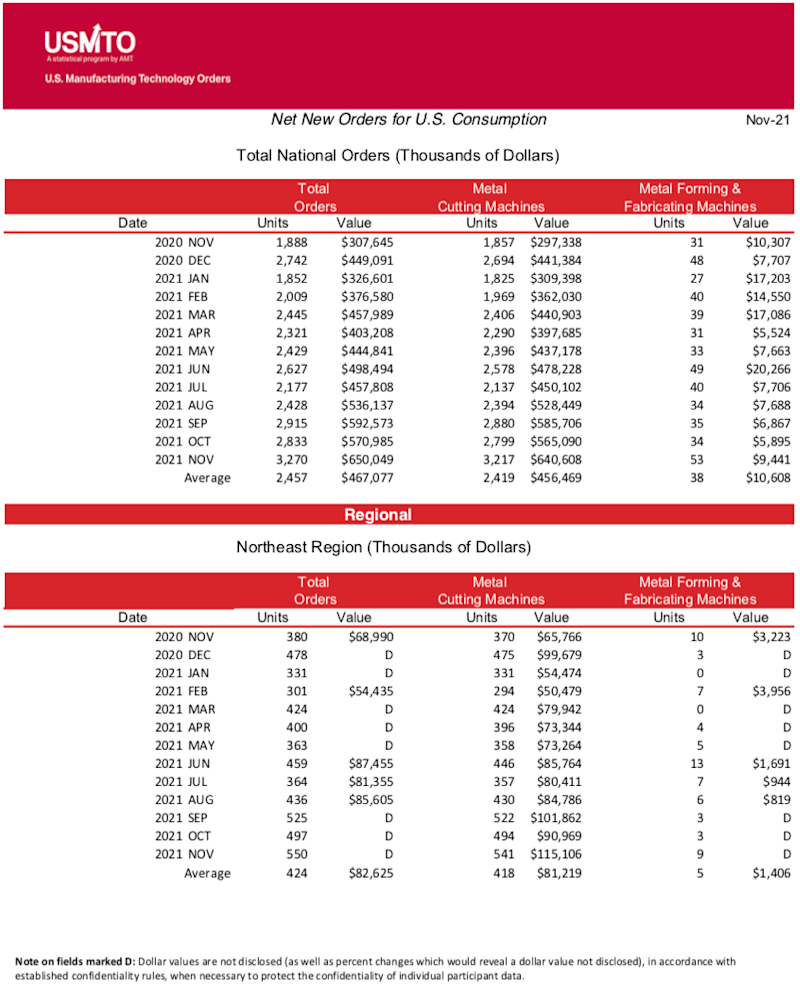

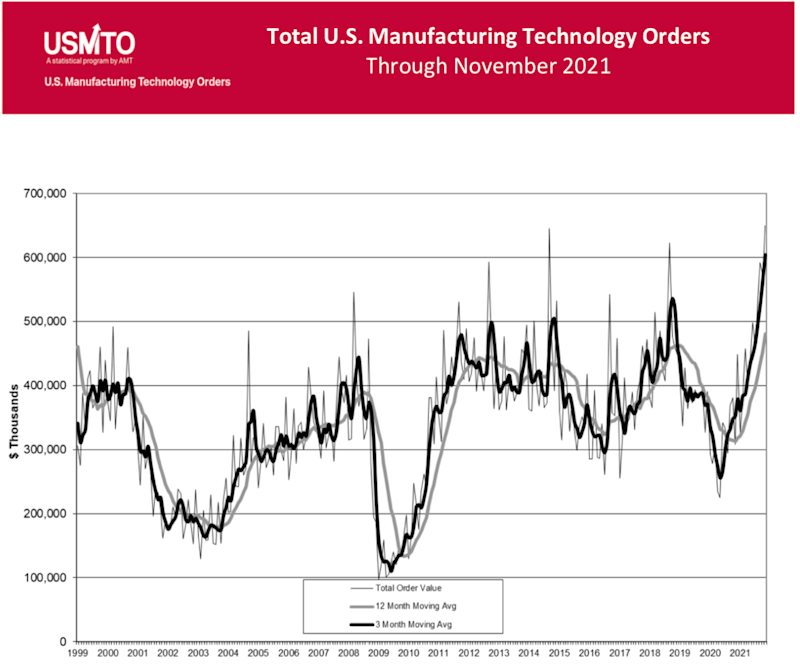

McLean, Va. (January 10, 2022) – Orders of manufacturing technology surpassed $650 million in November 2021, according to the latest U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology. This is the second-highest monthly total and only the fifth instance monthly orders have exceeded $600 million since the beginning of the program in 1998. The value of orders was up nearly 14% from October 2021 and more than double the value of orders received in November 2020. The year-to-date total topped $5.3 billion, about $340 million short of becoming the best year in the history of the program.

“November orders illustrate continued recovery despite ongoing challenges brought on by the pandemic. Tool and die, valve manufacturing, forging and stamping, and hardware – sectors in decline due to decades of outsourcing prior to the pandemic – continued to make a comeback due to reshoring,” said Douglas K. Woods, president of AMT. “Job shops showed a modest decline in dollars spent but a double-digit increase in orders, indicating an industry-wide need for increased capacity.”

Two primary sectors that show increased orders despite continued challenges are aerospace and off-road equipment. The aerospace sector has experienced challenges with flight cancellations and staffing issues that may dampen any near-term plans to increase fleet sizes. However, despite these disruptions, this sector has nearly doubled its orders from the previous month. Heavy off-road equipment used for agriculture, mining, and construction have also increased by multiples over October 2021, likely due to anticipated interest rate hikes.

“The sectors that make large-scale off-road equipment require more complex and highly customized machinery to make them, and they tend to be dependent on financing and sensitive to interest rates,” said Woods. “Orders coming from these rate-sensitive sectors in November may have been an attempt to lock in financing prior to the December Federal Reserve meeting, preempting any surprises that would increase the cost of borrowing.”

Despite the index slipping in December 2021, the ISM Manufacturing Purchasing Managers’ Index remained solidly within growth territory. “Manufacturers have learned that supply chain disruptions and labor shortages are part of the landscape and are developing short and long-term strategies to address these challenges,” said Woods. “If manufacturers can continue to successfully adapt, I can see the momentum of the manufacturing technology industry continuing into 2022.”