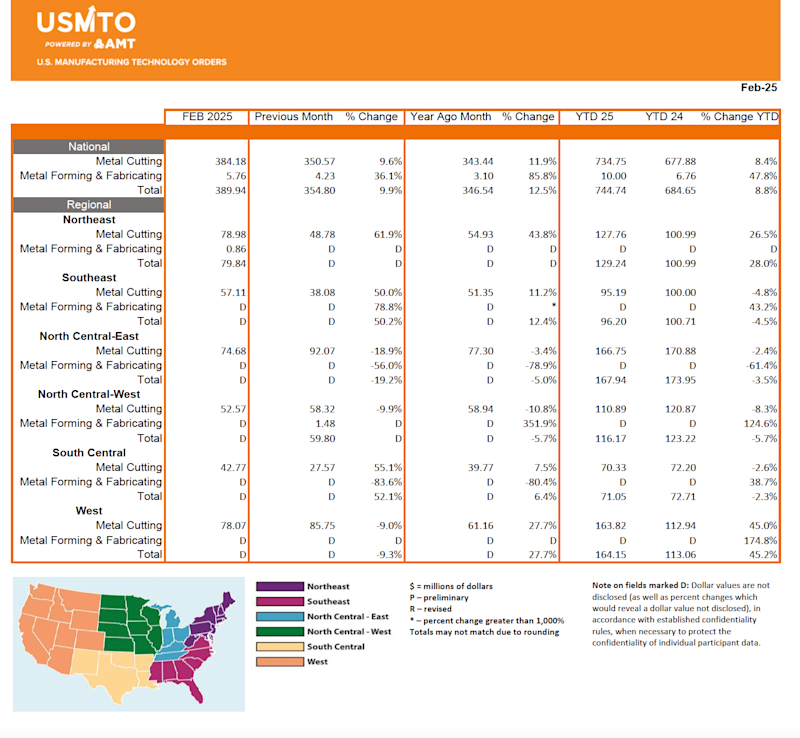

McLean, Va. (April 14, 2025) – New orders of metalworking machinery, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology, totaled $389.9 million in February 2025, a 9.9% increase from January and a 12.5% increase from February 2024. Through the first two months of the year, orders totaled $744.74 million, an 8.8% increase over the first two months of 2024.

Through the first two months of 2025, it seems as if the optimistic forecast for machine tool orders had begun to materialize. In addition to the uptick in the value of machinery ordered, unit sales have rebounded in 2025. For much of 2024, growth in the number of units sold lagged the increase in the total value of orders. That trend has reversed in 2025, with the number of units ordered 9.6% above the first two months of 2024.

Contract machine shops, the largest consumer of manufacturing technology, increased orders by nearly 25% over January but were short of the levels that closed in 2024.

The value of orders placed by aerospace manufacturers declined sharply from January to February, but the number of units increased slightly. This indicates the industry is buying machinery to overcome capacity constraints. This is confirmed by capacity utilization for the aerospace and miscellaneous transportation sector exceeding the level seen before the Boeing machinist strike for the first time in February 2025.

Order values of machinery placed by electrical equipment manufacturers were roughly flat from January to February, but the number of units ordered nearly doubled. While order activity remains elevated amid an ongoing transformer shortage, it could be at risk if recent plans to shutter data center development expand.

In response to the new tariff regime announced by the Trump administration at the beginning of April, many forecasters downgraded their expectations for 2025 growth as uncertainty grew. Amid this environment, many major stock indices experienced declines. Since the stock market reflects expectations of future corporate profitability, the observed declines could be interpreted as waning confidence in future demand from consumers. In an alternate interpretation, companies may not be able to pass the full cost of inputs on to customers after an extended bout of inflation has increased business and consumer price sensitivity. In this scenario, manufacturers who invest in newer, more efficient technologies could help recoup some of that lost profit margin through cost-saving process improvements.

Register for AMT’s Spring Economic Update Webinar on Thursday, May 8, to hear how these changing market dynamics will affect the outlook for machinery orders in 2025.