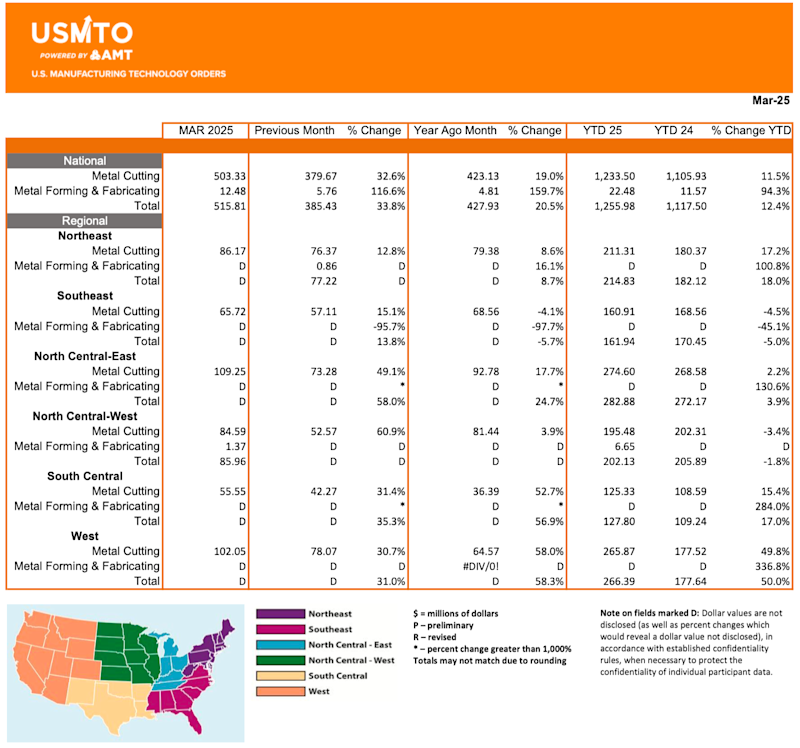

McLean, Va. (May 12, 2025) — New orders of metalworking machinery, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology, totaled $515.8 million in March 2025, the highest monthly value since March 2023. March 2025 orders increased 33.8% from February 2025 and were up 20.5% from March 2024. Through the first quarter of the year, orders totaled $1.26 billion, a 12.4% increase over the first quarter of 2024.

Even with a massive increase of private investment in equipment in the first quarter of 2025, orders of manufacturing technology fell by 5.7% from the previous quarter. However, the decline was not significant enough to derail the upward momentum of the industry that began with IMTS – The International Manufacturing Technology Show in September 2024.

After driving growth in the machinery market over the past several months, orders from contract machine shops underperformed the overall market movements in March 2025. When demand increases for goods and equipment that require machined parts, contract machine shops generally experience capacity constraints as OEMs shift more work toward them and weigh how to handle changing demand over longer time horizons. Meeting this immediate need by the smaller shops requires additional investment in machinery.

Aerospace manufacturers increased their orders in March 2025 to the highest monthly value on record and the most units ordered since December 2023. In February 2025, the capacity utilization rate of aerospace manufacturers surpassed the level observed before the Boeing machinists strike for the first time since the end of the strike in November 2024. While the industry is positioned to continue its upward trajectory, the current strike of machinists could be another short-term drag on growth.

The first quarter of 2025 showed strong signs that demand for manufacturing technology was beginning to recover after two years of mild decline. Increasing uncertainty and downside risks to the economy could upend the positive path of manufacturing technology orders. After forecasting robust growth in 2025, Oxford Economics recently revised its outlook to a high single-digit decline, as economic conditions could push the recovery in machinery demand to the latter half of 2026.

The United States Manufacturing Technology Orders (USMTO) Report is based on the totals of actual data reported by companies participating in the USMTO program. This report, compiled by AMT – The Association For Manufacturing Technology, provides regional and national U.S. orders data of domestic and imported machine tools and related equipment. Analysis of manufacturing technology orders provides a reliable leading economic indicator as manufacturing industries invest in capital metalworking equipment to increase capacity and improve productivity. USMTO.com.

AMT – The Association For Manufacturing Technology represents U.S.-based providers of manufacturing technology – the advanced machinery, devices, and digital equipment that U.S. manufacturing relies on to be productive, innovative, and competitive. Located in McLean, Virginia, near the nation’s capital, AMT acts as the industry’s voice to accelerate the pace of innovation, increase global competitiveness, and develop manufacturing’s advanced workforce of tomorrow. With extensive expertise in industry data and market intelligence, as well as a full complement of international business operations, AMT offers its members an unparalleled level of support. AMT also produces IMTS – The International Manufacturing Technology Show, the premier manufacturing technology event in North America. Learn more at AMTonline.org.

IMTS – The International Manufacturing Technology Show is where the creators, builders, sellers, and drivers of manufacturing technology come to connect and be inspired. Attendees discover advanced manufacturing solutions that include innovations in CNC machining, automation, robotics, additive, software, inspection, and transformative digital technologies that drive our future forward. Powered by AMT – The Association For Manufacturing Technology, IMTS is the largest manufacturing technology show and marketplace in the Western Hemisphere. With more than 1.2 million square feet of exhibit space, the show attracts visitors from more than 110 countries. IMTS 2024 had 89,020 registrants, featured 1,737 exhibiting companies, and included a Student Summit that attracted 14,713 visitors. Be the change at IMTS 2026, Sept. 14-20, 2026. Inspiring the Extraordinary. IMTS.com.