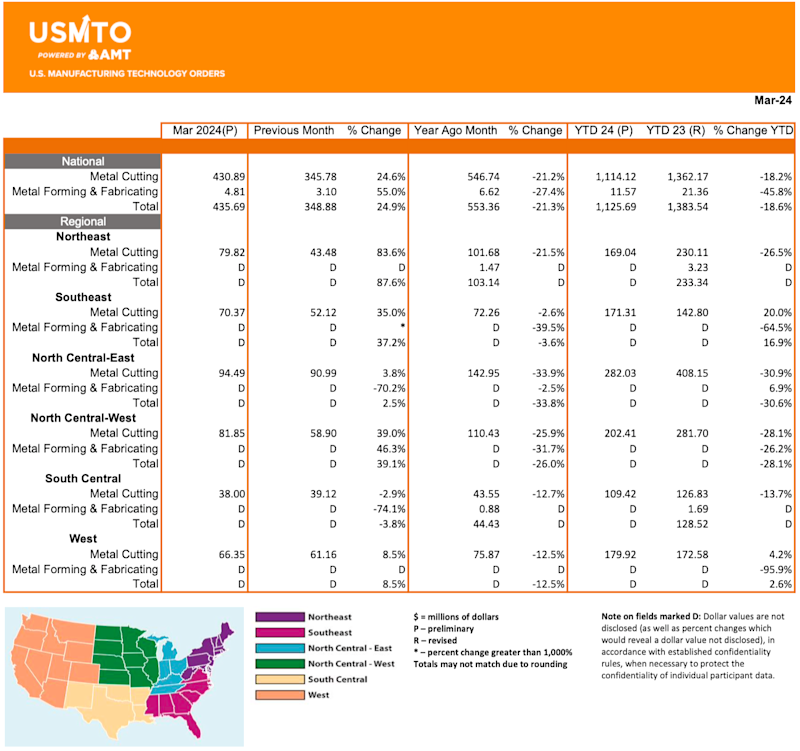

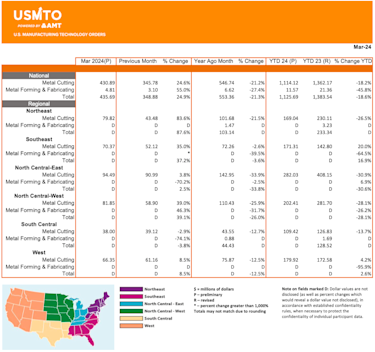

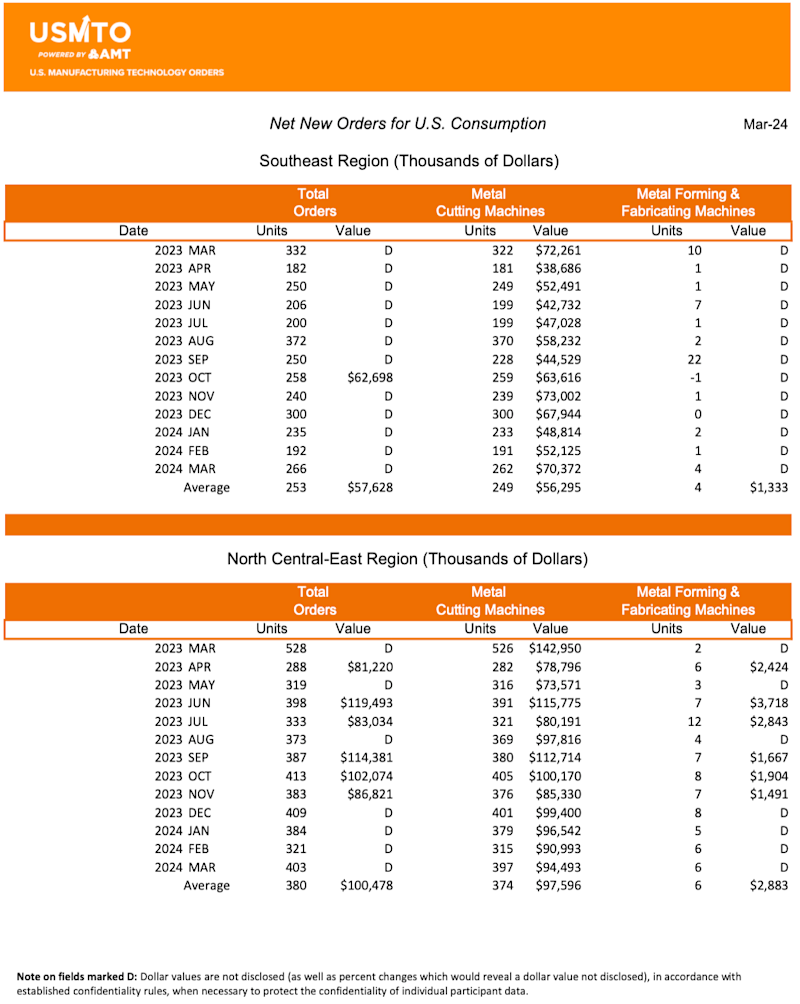

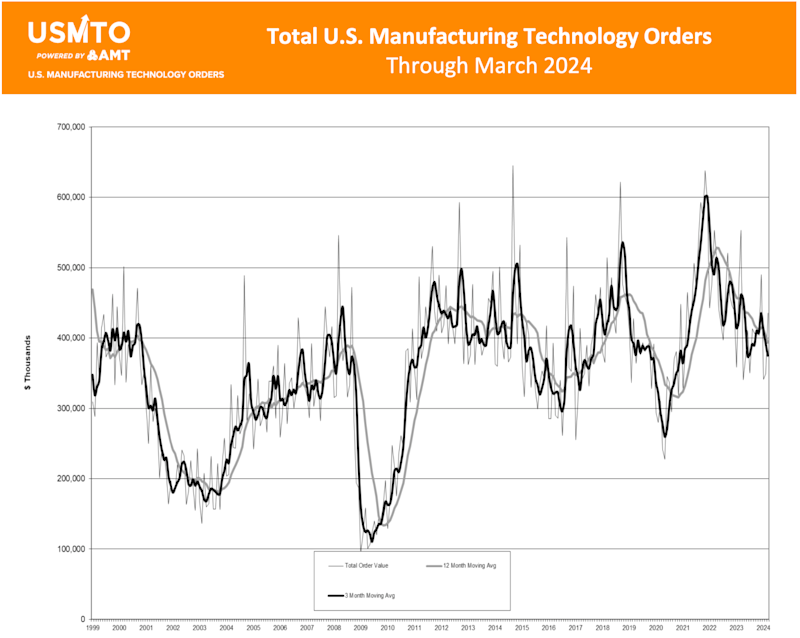

McLean, Va. (May 13, 2024) — Orders of manufacturing technology, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology, reached $435.7 million in March 2024. Orders grew nearly 25% above the February 2024 level. March orders are typically a large increase from February, as many builders of manufacturing technology end their fiscal year in March. Although the typical bump over February was seen in the data, March 2024 orders were 21.3% below those of March 2023. Year-to-date orders reached $1.13 billion, an 18.6% decline from orders in the first quarter of 2023.

Forecasts from the beginning of the year relied at the time on the widely accepted belief that the Federal Reserve would reduce interest rates three times over the course of 2024. As time went on, inflation remained stubbornly high, the labor market retained its strength, and the probability of rate cuts dwindled. This led to the Federal Reserve’s “higher for longer” interest rate strategy, which has been limiting growth and causing some hesitation for business investment. Despite this general unease, there remain several pockets of opportunity driven by government spending and technological advancement.

Orders from contract machine shops increased in March 2024 to their highest level in the last year. Despite this increase, average monthly orders from contract machine shops are 11.3% lower in 2024 than in 2023. Customers ordering parts from contract machine shops have increasingly turned away from longer-term procurement cycles in favor of placing month-by-month orders or making sporadic, one-off purchases. As a result, machine shops have been hesitant to make additional machinery investments.

Electrical generation and power transmission equipment manufacturers helped drive the increase in orders from February to March 2024, which reached their highest level since March 2023. Orders from this sector had been on an upward trend since September 2023 because of government investment in new energy technologies. This sector is positioned to become a reliable source of growth in the future from the increasing need for energy as our economy becomes more digitalized and AI begins to play a larger role in daily life.

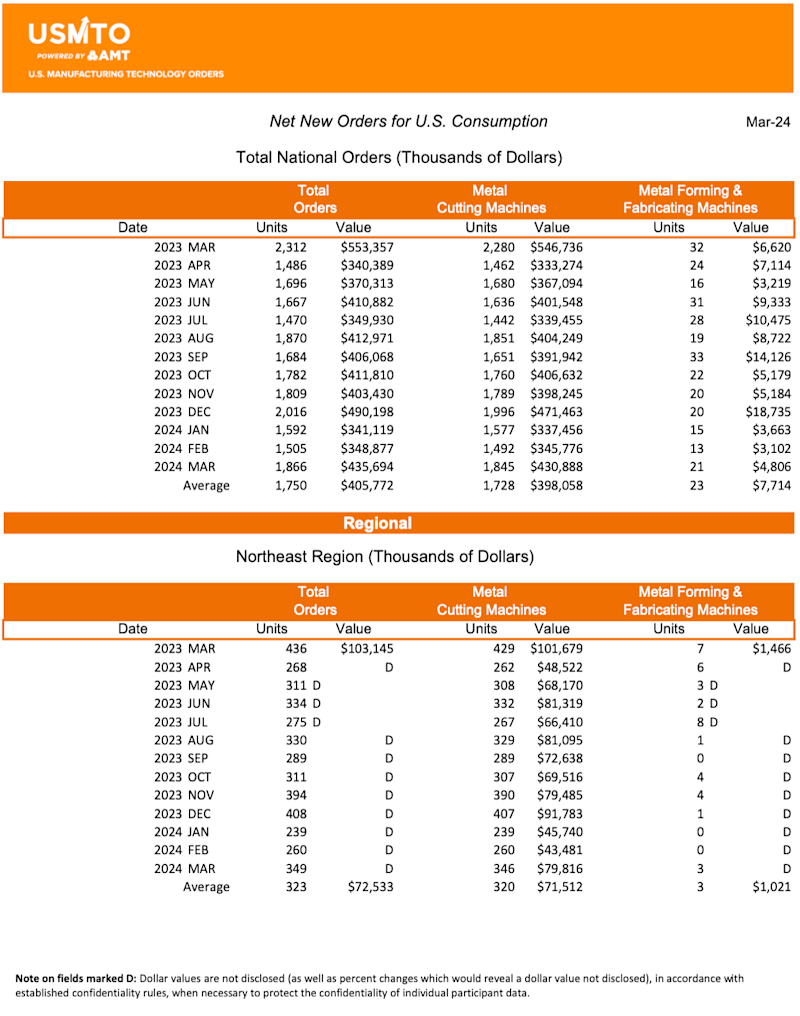

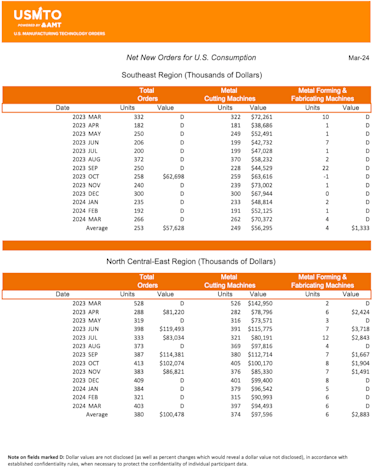

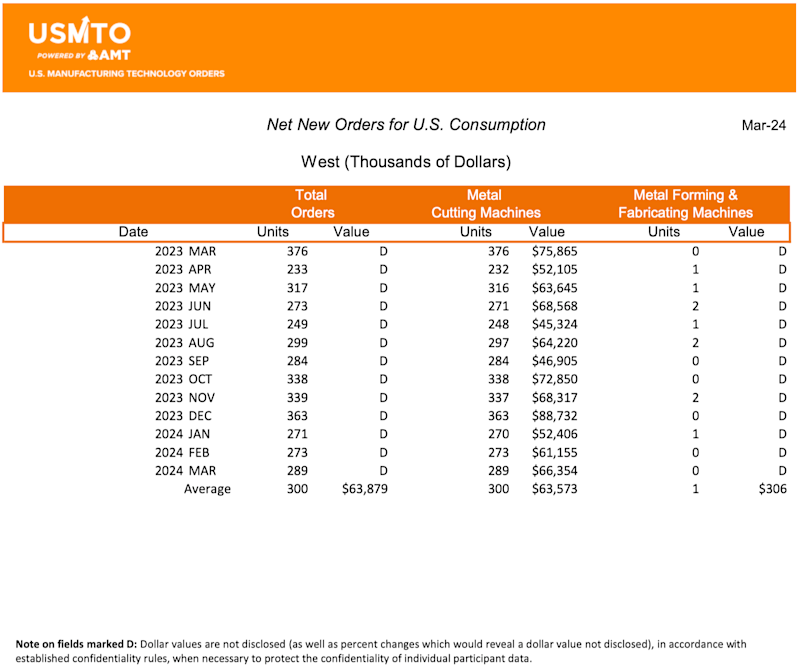

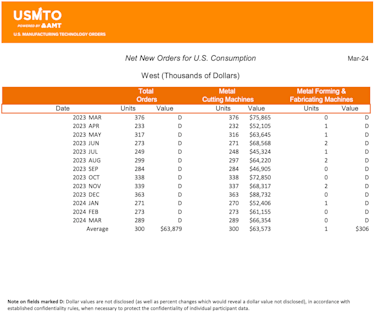

Bucking the national trend, both the Southeast and West regions showed growth in manufacturing technology orders when comparing the first quarters of 2023 and 2024. Orders in the Southeast were driven by a massive increase in orders from the aerospace sector as military investment in projects increased in recent months, and some manufacturers relocated from states with less favorable business environments. Growth in the West was driven by orders from computer and electrical equipment manufacturers as government and private investment in semiconductor manufacturing comes online.

To learn more about the economic trends highlighted above and the updated forecast for manufacturing technology orders, AMT is hosting the Spring Economic Update Webinar on May 13 at 1:00 p.m. EDT. Register now to reserve your space.

# # #

The United States Manufacturing Technology Orders (USMTO) Report is based on the totals of actual data reported by companies participating in the USMTO program. This report, compiled by AMT – The Association For Manufacturing Technology, provides regional and national U.S. orders data of domestic and imported machine tools and related equipment. Analysis of manufacturing technology orders provides a reliable leading economic indicator as manufacturing industries invest in capital metalworking equipment to increase capacity and improve productivity. USMTO.com.

AMT – The Association For Manufacturing Technology represents U.S.-based providers of manufacturing technology – the advanced machinery, devices, and digital equipment that U.S. manufacturing relies on to be productive, innovative, and competitive. Located in McLean, Virginia, near the nation’s capital, AMT acts as the industry’s voice to speed the pace of innovation, increase global competitiveness, and develop manufacturing’s advanced workforce of tomorrow. With extensive expertise in industry data and intelligence, as well as a full complement of international business operations, AMT offers its members an unparalleled level of support. AMT also produces IMTS – The International Manufacturing Technology Show, the premier manufacturing technology event in North America. AMTonline.org.

IMTS – The International Manufacturing Technology Show is where the creators, builders, sellers, and drivers of manufacturing technology come to connect and be inspired. Attendees discover advanced manufacturing solutions that include innovations in CNC machining, automation, robotics, additive, software, inspection, and transformative digital technologies that drive our future forward. Powered by AMT – The Association For Manufacturing Technology, IMTS is the largest manufacturing technology show and marketplace in the Western Hemisphere. With more than 1.2 million square feet of exhibit space, the show attracts visitors from more than 110 countries. IMTS 2022 had 86,307 registrants, featured 1,816 exhibiting companies, saw over 7,600 people attend educational events, and included a Student Summit that introduced the next generation to manufacturing. Be the change at IMTS 2024, Sept. 9-14, 2024. Inspiring the Extraordinary. IMTS.com.