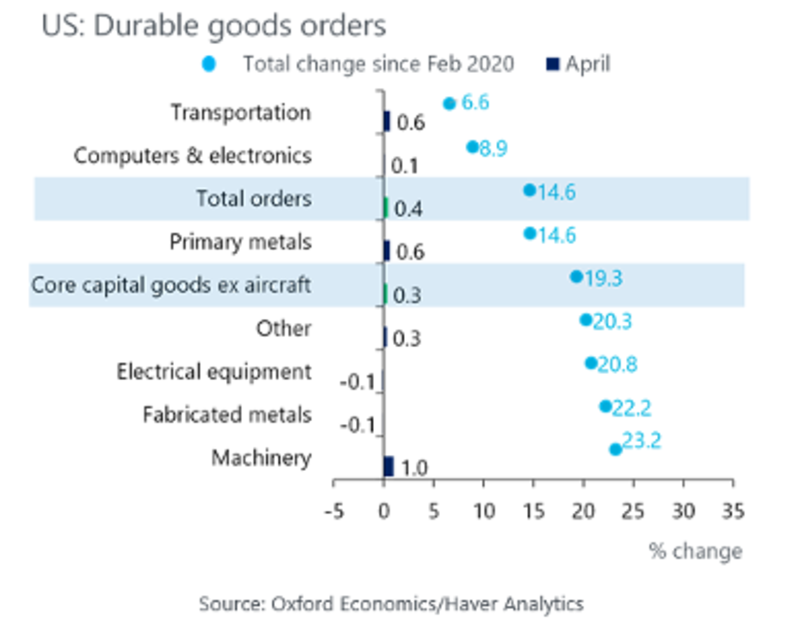

Headline, nominal durable goods orders climbed 0.4% in April following a revised 0.6% increase in March (from 0.8% previously). Transportation (0.6%) orders climbed higher with a rise in aircraft orders (up 3.5%), driven by stronger nondefense and defense aircraft orders, more than offsetting a slip in motor vehicle orders (down 0.2%). Excluding transportation, durable goods orders rose for a second consecutive month, up 0.3%.

While April’s increases were less impressive than March, Oxford Economics doesn’t believe this signals an oncoming deterioration in business equipment spending. We should expect some moderation in the pace of gains as the recovery matures and tilts in favor of services. Further, a positive fundamental backdrop of solid demand and constrained supply will support equipment spending growth.