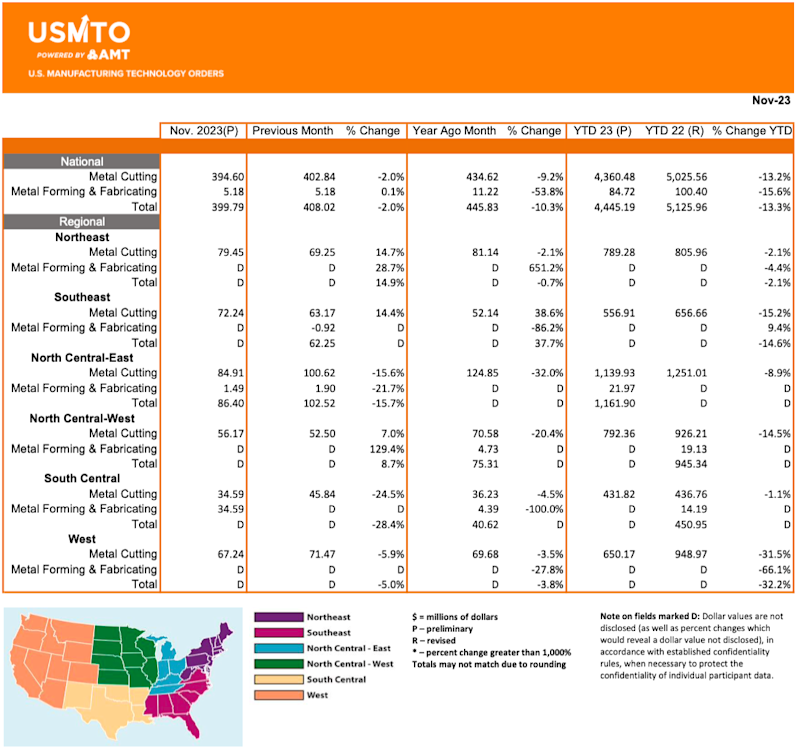

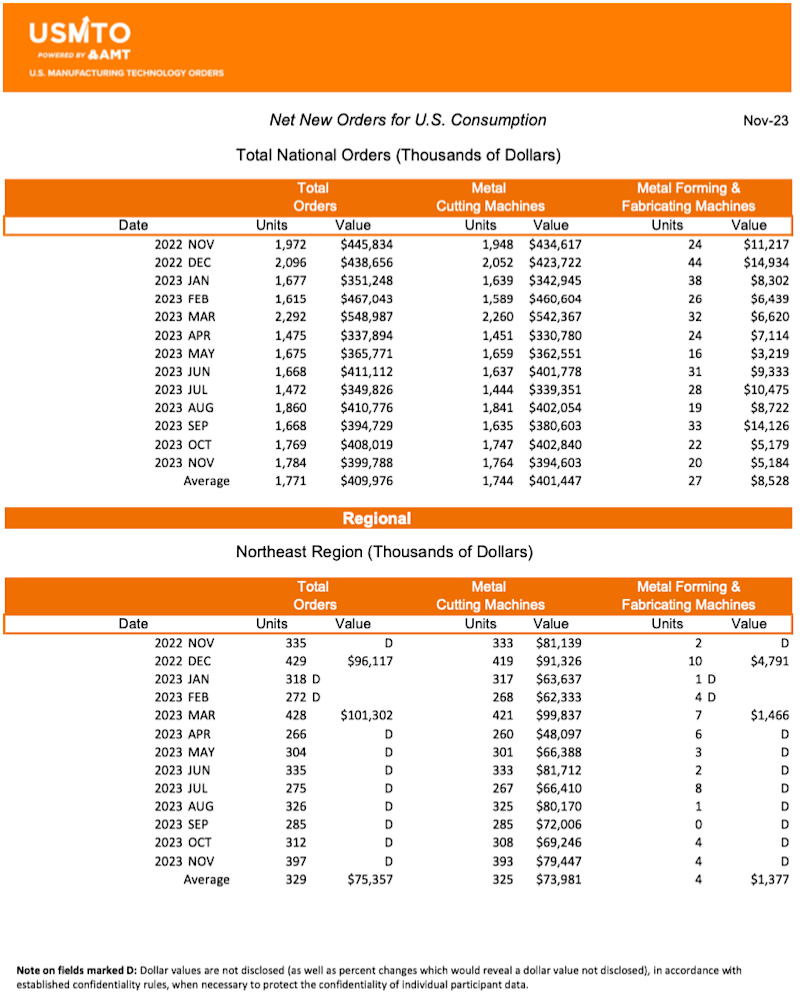

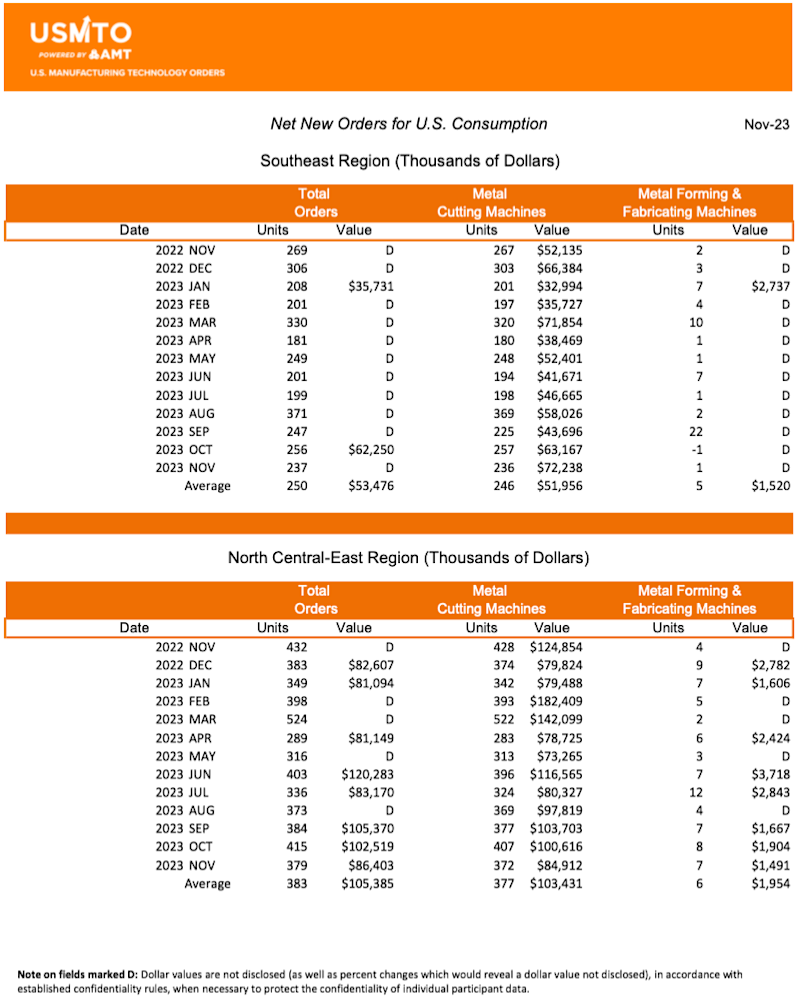

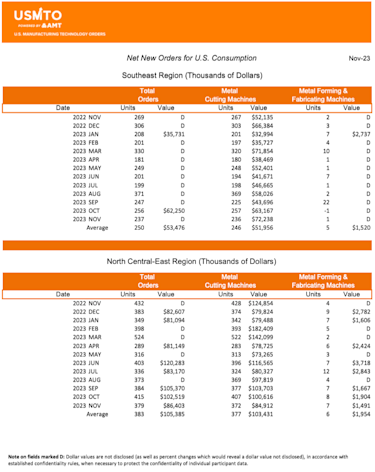

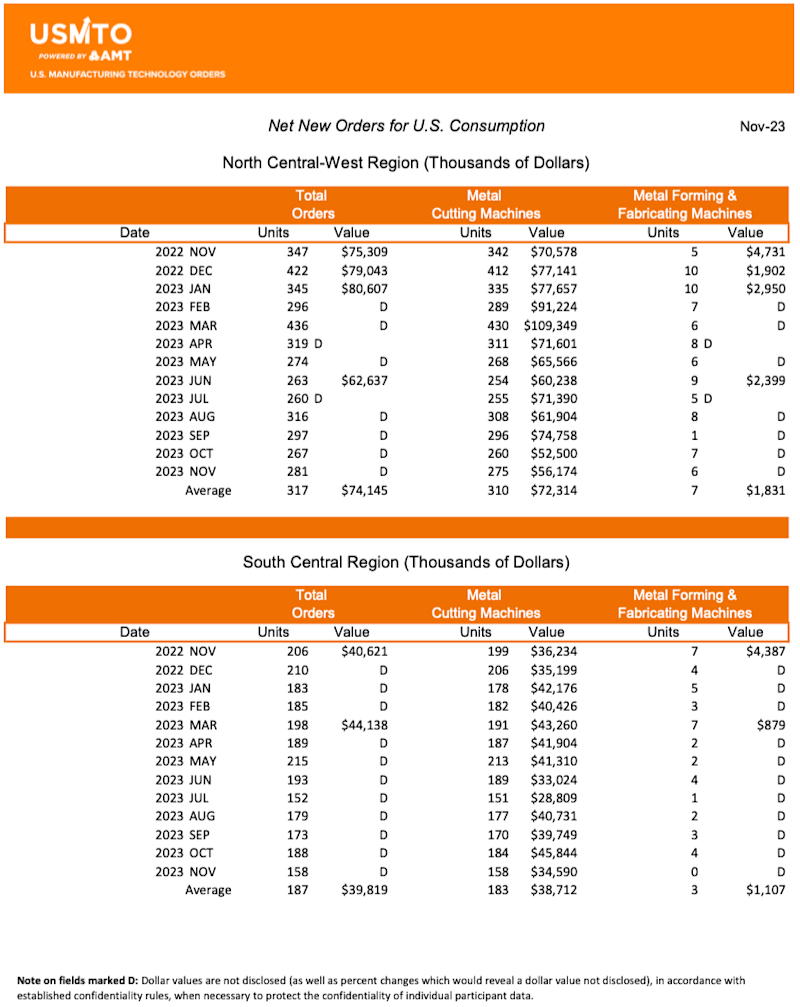

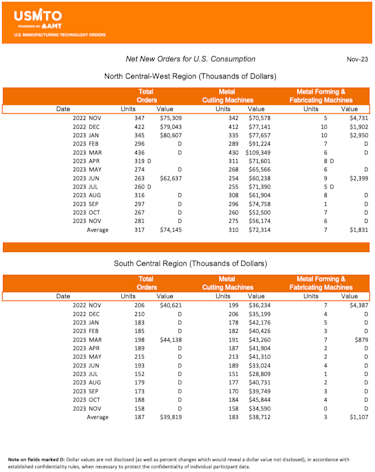

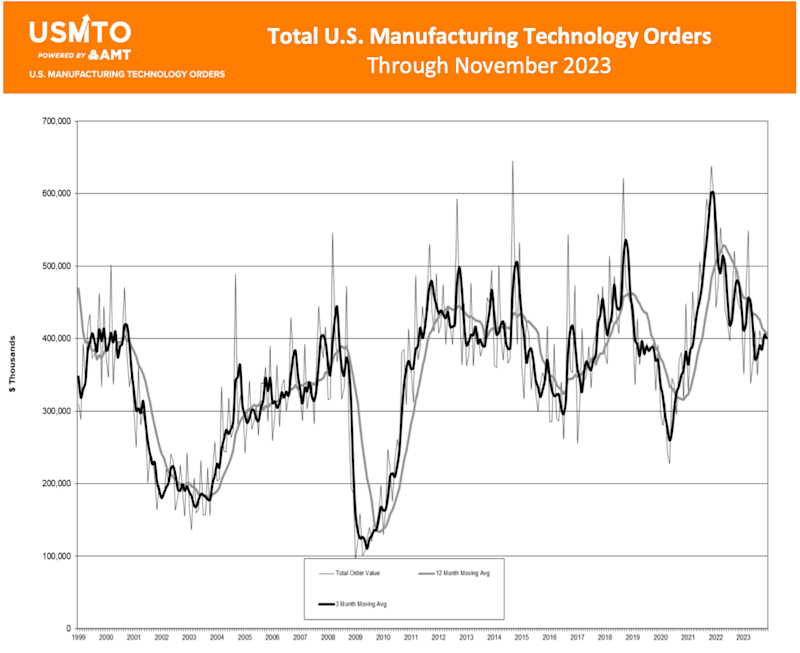

McLean, Va. (January 9, 2024) — The soft landing the U.S. economy generally experienced through 2023 did not affect all sectors of the economy evenly. Even in the face of improving economic health, orders of manufacturing technology, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology, consistently fell short of orders placed in 2022. November 2023 was no different, with orders falling to $399.8 million, 10.3% lower than those placed in November 2022 and 2% behind orders placed in October 2023. Year-to-date orders reached $4.45 billion in 2023, 13.3% below the same period in 2022.

Contract machine shops, the largest consumer of manufacturing technology, decreased their November 2023 orders by nearly 16% from October 2023. The decline was nearly balanced by increases from other manufacturing sectors. Of those sectors that increased orders in November, aerospace manufacturers peaked at 60% above the monthly average compared to the rest of 2023. Electrical equipment manufacturers also increased orders. Tight conditions in the labor market persisting through the holiday travel and shopping seasons necessitated additional investment in automation to help manufacturers meet consumer demand.

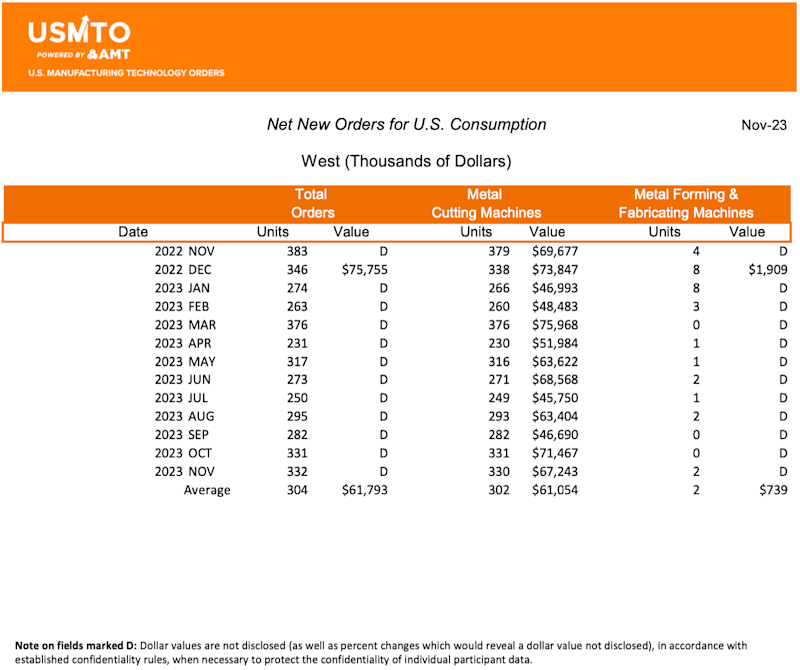

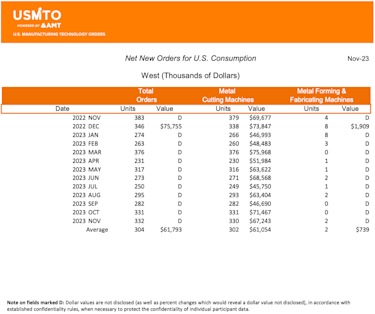

While overall orders for the year were down compared to their near-record levels in 2022, several regions and industries saw a late-year rally, showing strong order activity through November 2023. The Northeast and South-Central regions only declined by around 2% from their 2022 totals – virtually flat compared to the steeper declines seen in other regions. The minimal comparative losses in these regions were driven by significant year-over-year growth in orders from aerospace manufacturers. The South-Central region also benefited from significant growth in orders from the automotive sector. The release of December 2023 USMTO data will determine if the November bright spots were outliers or the beginning of a rebound that could drive manufacturing technology investment into 2024.

# # #

The United States Manufacturing Technology Orders (USMTO) Report is based on the totals of actual data reported by companies participating in the USMTO program. This report, compiled by AMT – The Association For Manufacturing Technology, provides regional and national U.S. orders data of domestic and imported machine tools and related equipment. Analysis of manufacturing technology orders provides a reliable leading economic indicator as manufacturing industries invest in capital metalworking equipment to increase capacity and improve productivity.

AMT – The Association For Manufacturing Technology represents U.S.-based providers of manufacturing technology – the advanced machinery, devices, and digital equipment that U.S. manufacturing relies on to be productive, innovative, and competitive. Located in McLean, Virginia, near the nation’s capital, AMT acts as the industry’s voice to speed the pace of innovation, increase global competitiveness, and develop manufacturing’s advanced workforce of tomorrow. With extensive expertise in industry data and intelligence, as well as a full complement of international business operations, AMT offers its members an unparalleled level of support. AMT also produces IMTS – The International Manufacturing Technology Show, the premier manufacturing technology event in North America. AMTonline.org

IMTS – International Manufacturing Technology Show – The largest and longest running manufacturing technology trade show in the United States is held every other year at McCormick Place in Chicago, Ill. IMTS 2024 will run Sept. 9-14. IMTS is ranked among the largest trade shows in the world. Recognized as one of the world’s preeminent stages for introducing and selling manufacturing equipment and technology as well as connecting the industry’s supply chain. IMTS attracts visitors from every level of industry and more than 117 countries. IMTS 2022 had 86,307 registrants, 1,212,806 net square feet of exhibit space, 1,602 booths, and 1,816 exhibiting companies. IMTS is owned and produced by AMT – The Association For Manufacturing Technology. www.IMTS.com