Essential Product Industries Drive Job Announcements to Record High Part 1

We have entered a watershed moment for U.S. manufacturing. Over the past decade, increasing understanding of the routine logistics costs of offshoring drove an upward trend of reshoring. However, a more substantial accelerator has been the geopolitical forces of the Russian invasion of Ukraine, domestic supply chain growth for clean energy, essential products revealed by COVID-19 pandemic, and the risk of China decoupling. These conditions have converged to prove that the risks of offshoring have an even greater impact than its routine logistics costs. The hazards of supply chain gaps and the advantages of domestic manufacturing propelled more and more companies to move production back to the United States, driving job announcements to a record high. Let’s examine the data and motivating factors.

Public / private push drives job announcements

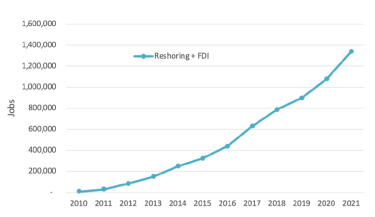

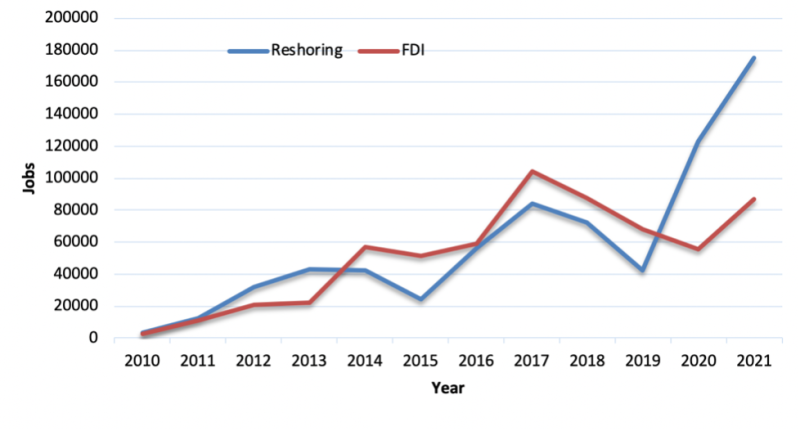

In 2021, the private and federal push for domestic supply of essential goods drove reshoring and foreign direct investment (FDI) job announcements to a record 261,000, bringing the total jobs announced since 2010 to over 1.3 million. For the second year in a row, reshoring exceeded FDI by 100%, in contrast to 2014 through 2019, when FDI exceeded reshoring. Additionally, the number of companies reporting reshoring and FDI set a record of over 1,800 companies. The Reshoring Initiative Data Report discusses the trend and how reshoring will continue to be key to U.S. manufacturing and economic recovery.

Exhibit 1 | Jobs Announced, Reshoring + FDI, Cumulative 2010-2021

Import shortages and geopolitical concerns accelerate reshoring

The strength of the reshoring and FDI trends in recent years is based on a combination of factors. Large announcements in 2021 were driven by government support for U.S. production of essential products spurred by import shortages observed during the pandemic and by the dramatic increases in freight cost and delivery time. Other important forces included greater U.S. competitiveness due to residual effects of the 2017 corporate tax and regulatory cuts, increased recognition of the total cost of offshoring and rising concern over geopolitical tensions, and U.S. dependency on China.

The high rate of 2020 and 2021 reshoring vs. FDI also indicates that U.S. headquartered companies are starting to understand the same benefit to localized production that many foreign companies have understood over the last decade.

Exhibit 2 | Job Announcements by Year, Reshoring and FDI, 2010-2021

Ongoing global supply chain disruption

GM, Micron, Lockheed, and other companies are reshoring due to global supply chain disruption. In 2022, GM announced a $7 billion investment in four Michigan electric vehicle (EV) manufacturing facilities that will create 4,000 new jobs. GM President Mark Reuss says, “The geopolitical risks posed to automotive supply chains by the war in Ukraine are real, but GM is managing the pressure, and is pushing ahead with its plans to speed up launches of new electric vehicles.”

In April 2022, Keith Harvey, chief executive at Kaiser Aluminum, told investors that the shift of companies moving back to North America is “becoming a more permanent fact,” due to ongoing supply chain disruptions. Denmark-based toymaker Lego is investing $1 billion to build a factory in the U.S. to shorten supply chains. “Our strategy to be close to our core markets has only been confirmed recently," Lego's Chief Operations Officer Carsten Rasmussen says..

U.S. Supply Chain growth for clean energy technology

The expansion of clean energy in the U.S. is ushering in a wave of public and private investment in the domestic supply chain. Volkswagen and Siemens are planning to invest upwards of $700 million to increase manufacturing capacity for electric vehicle (EV) chargers, adding 2,000 jobs and making charging more accessible and affordable. In June 2022, President Biden invoked the Defense Production Act (DPA) to expand the manufacturing[ML1] of energy saving technologies including solar, transformers and electric grid components, heat pumps, insulation, electrolyzes, fuel cells, and platinum group metals.

Thirteen new battery cell gigafactories have recently been announced that will be operational by 2025. First Solar is investing $680 million to expand U.S. domestic PV solar manufacturing capacity by building its third U.S. manufacturing facility in Ohio. Creating a domestic supply chain for clean energy technology will create jobs, help fight climate crisis, and strengthen U.S. national and economic security.

Wall Street shift strengthens reshoring

Wall Street’s focus on short-term profits was a major force driving companies to offshore for the last 40 years. Major banks, financial institutions, and private equity companies have recently taken notice of the companies reporting reshoring and seek to identify companies that will benefit most from reshoring. Wall Street’s shift from the rewards of offshoring to encouragement for reshoring should help strengthen an already robust reshoring trend. The Reshoring Initiative is also talking with several private equity companies to help them identify firms with opportunities for outsize gains by selling or buying smarter, riding the reshoring wave.

Are you thinking about reshoring?

In part two of this two-part series, I will discuss “doing the math” to see if reshoring makes economic sense for your company. I’ll also explore workforce trends and future projections. Look for me and The Onshoring Project at IMTS 2022 where we look forward to discussing reshoring successes and opportunities with you.