The current pandemic and the U.S. economic, manufacturing, and supply chain vulnerabilities it has exposed have led to a renewed concern among many business leaders, policymakers, and economists about ways to strengthen the U.S. industrial base. There is a wide variety of thinking on the subject, and some proposed solutions are not mutually exclusive. They include increasing public sector investment in public-private partnerships (PPP), incentivizing companies to reshore parts of their supply chain, and strengthening the manufacturing and manufacturing technology (MT) sectors through tax credits, subsidies, and R&D investments in critical technologies.

The pandemic has also made clear the critical role that manufacturing plays in ensuring U.S. national security in terms of accessing adequate medical supplies as well as any other scarce resource, such as defense-related supplies. In the future, the United States may look back at the present time and see a pivot toward greater collaboration between the public and private sectors and an overall greater emphasis on national security in all its forms.

Public-private partnerships

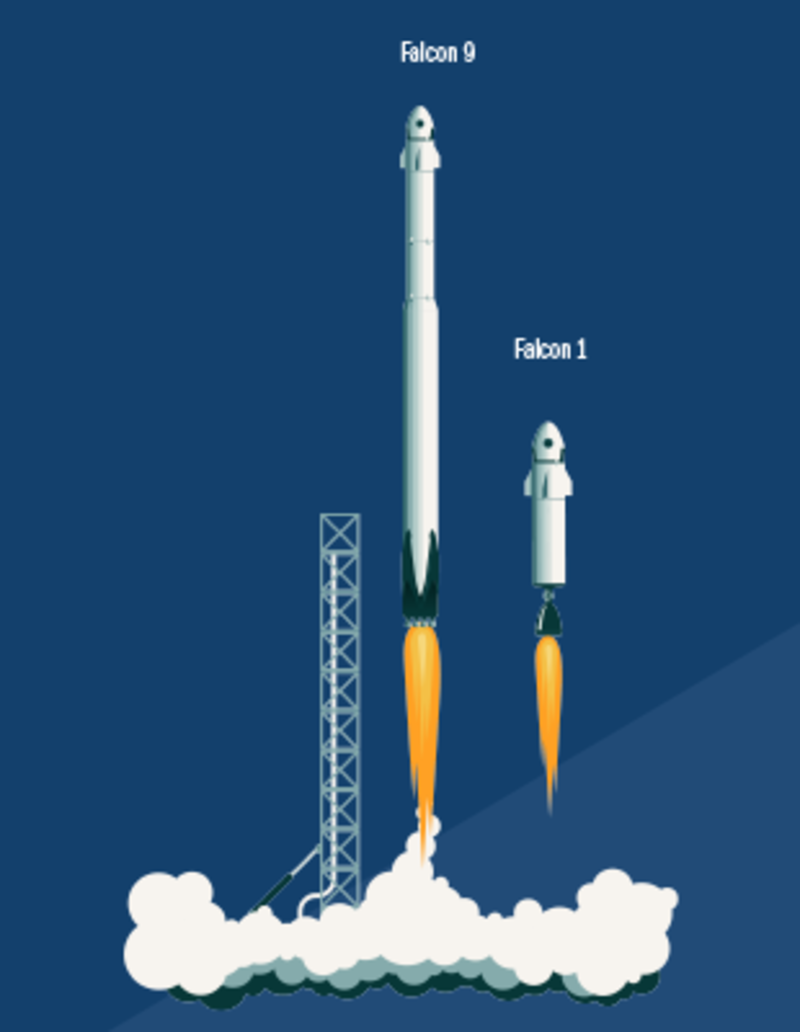

Not all public-private partnerships require consortium agreements, grant funding, or tiered membership models. One of the most successful, visible, and demand-driven PPPs of the past decade has been NASA’s Commercial Crew Program with, perhaps, its most visible private partner, SpaceX. While SpaceX, the aerospace manufacturer and space transportation company founded in 2002 by Elon Musk, is not the only private sector company working with NASA, it has received the lion’s share of attention. SpaceX, with its Starlink satellite constellation, Dragon spacecraft, and Falcon rockets, is the first private company to send astronauts to the International Space Station (ISS); the first private company to successfully launch, orbit, and recover a spacecraft; and the world’s largest commercial satellite constellation operator.

The partnership has been a win-win for both SpaceX and NASA and serves as a strong model for future public-private collaborations. SpaceX brings advanced and innovative technology, agility, and speed to projects, and NASA brings breadth of technical expertise, financing, and in-depth knowledge of how materials and spacecraft actually behave in flight. Using private-sector expertise and a more streamlined approach to build the spacecraft has saved NASA a huge amount of money. For example, the total development cost for both the Falcon 1 and Falcon 9 rockets was estimated by NASA to be approximately $390 million, whereas using its traditional contracting processes would have cost the agency an estimated $4 billion to develop just the Falcon 9 rocket by itself.

While SpaceX builds most of its fleet of rocket engines, spacecraft, avionics, and software in-house, it also uses thousands of suppliers.

SpaceX does not readily disclose information about its suppliers, but certain information is in the public domain. Additively manufactured (AM) parts are included in every launch vehicle, and SpaceX has publicly shared information on AMT member EOS North America providing AM components to the company.

AMT member Hardinge Inc., a global provider of advanced metal-cutting solutions, provided a Kellenberger 100 grinding machine to SpaceX for use on its engines. “We work largely in the aerospace industry where there is a need for low volume, high precision machines,” said Jeff Hilliard, senior account manager, Hardinge. “Several SpaceX suppliers were using the Kellenberger, and this led to a direct purchase by SpaceX.”

AMT member Toyoda Americas Corp. sold 10 5-axis CNC machines to a SpaceX supplier. “They are using our machines to make aluminum and titanium parts with unique contours and shapes for SpaceX satellites,” said Tim Leoni, vice president of sales, Toyoda Americas Corp. “The supplier was originally using the machines for commercial aviation work at Boeing, but as work there slowed, the machines were transferred to the SpaceX work.”

Work in the space industry promises to be an ongoing opportunity for the MT industry. “The size of the space industry is currently estimated to be $400 billion worldwide, and it is estimated to grow to as much as $3 trillion in the next 20 years,” said Glynn Fletcher, president, EOS NA.

There are many other partnerships that do not get as much attention as SpaceX. NASA is partnering with the private sector in several other of its programs, including the Artemis program and the Mars Exploration Program. As part of the Artemis program, NASA chose three U.S. companies earlier this year to develop equipment to land astronauts on the moon – Dynetics, Blue Origin, and SpaceX. The Dynetics team includes about 25 subcontractors, with Dynetics serving as the prime contractor and system integrator. Many of the subcontractors are small-to-medium manufacturers (SMMs) chosen for their specialized expertise.

Additional forms of public sector investment

Investing in or incentivizing emerging and advanced technologies vital to the U.S. national interest, such as artificial intelligence (AI), advanced communications, and advanced manufacturing, benefits the nation as a whole. Significantly, most of these technologies have either a primary or secondary manufacturing application.

The public sector – through policy and federal agencies – has many ways it can encourage investment in technologies or specific sectors of the economy that policymakers deem critical to the economic strength and resilience of the nation. These include tax incentives, federal guarantees, and subsidies.

Coming down the pike: A $100 billion plan to remake NSF

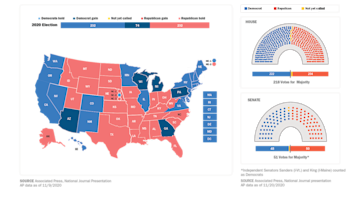

Under bipartisan bills that were introduced in both chambers of Congress in May, the National Science Foundation (NSF) would add “Technology” to its name and national purpose, receive a significant $100 billion in federal investment, and take on responsibility for maintaining U.S. global leadership in innovation to strengthen research in advanced, emerging, and critical technologies. Additionally, new university-based technology centers would be created to pursue focused and sustained research in 10 key areas including AI, machine learning, robotics, automation, and advanced manufacturing to develop prototypes of high-tech products and processes that companies could eventually bring to market. The Department of Commerce would also be authorized to spend $10 billion on 10-15 regional technology hubs to foster innovation in areas outside the country’s current technology hot spots.

Incentivizing domestic production

The United States has historically resisted the idea of the government setting “industrial policy,” so subsidizing industry directly is not usually the primary plan. Yet while corporate tax reduction several years ago was designed to incentivize companies to bring some of their operations back to the United States, multinational U.S. companies made decisions based on shareholder value and continued to move operations to regions that would provide the greatest ROI.

In many countries, such as Germany and China, the government plays a role in setting a national industrial policy, picking the winners and losers in terms of emerging and advanced technologies in which they want to invest. Some now believe new approaches are needed here. U.S. policymakers have introduced a spate of proposals in the past year – and even more since the pandemic exposed supply chain vulnerabilities – to incentivize U.S. companies to move some of their operations back to U.S. soil or to establish new entities to begin production in the United States.

Legislation has been introduced to incentivize domestic production of both rare earths and microchips, both critical industries. Virtually every computer, monitor, and other advanced electronics device today contains rare earth components from China, the global leader in rare earth mining, processing, and manufacturing. Sen. Marco Rubio, R-Fla., recently introduced legislation – the RE-Coop 21st Century Manufacturing Act – to establish a privately funded, operated, and managed Rare Earth Refinery Cooperative to coordinate the establishment of a fully integrated domestic rare earth value chain to serve U.S. national security interests. The bill uses the cooperative model as a proven way to correct for failed markets without relying on heavy-handed federal intervention.

Microchips are another area of U.S. vulnerability. Semiconductors are the basis of nearly all innovation today and are critical to U.S. communications and defense computing capabilities. While the United States leads the world in chip design, about 88% are manufactured outside of the United States, according to the Semiconductor Industry Association. In June, a bipartisan group of lawmakers proposed allocating tens of billions of dollars to boost semiconductor production and development in the United States. Additional efforts would create a tax credit for building a semiconductor factory in the United States or buying semiconductor manufacturing equipment. Additional legislation could dedicate up to $12 billion to semiconductor research at various federal agencies.

Additive manufacturing and rockets

AM is finding widespread applications in R&D efforts across the aerospace industry due to its ability to produce complex parts cost effectively. U.S. aerospace company Rocket Lab’s Electron launch vehicle is powered by nine 3D-printed Rutherford engines. The engines are powered by 3D-printed liquid propellants, which are produced using electron beam melting technology.

In 2017, U.S. space company Rocket Crafters Inc. (RCI) received a $542,600 research contract from the Defense Advanced Research Projects Agency (DARPA) to develop its hybrid 3D-printed rocket engine. Using their proprietary Direct-Digital Advanced Rocket Technology (D-DART), RCI aimed to combine the benefits of both 3D-printed solid rocket fuel grains and liquid propellants to create an engine capable of 5,000 pounds of peak thrust.

The European Space Agency (ESA) has tested a full scale, 3D-printed rocket engine named BERTA. Developed by ArianeGroup at ESA, the engine was produced using selective laser melting (SLM) and from a nickel-based alloy for the injection head and stainless steel for the combustion chamber.

In another first, German metal 3D-printer manufacturer SLM Solutions produced the “world’s largest rocket engine,” in 2019. Built on behalf of the British spaceflight company Orbex, the engine was 3D printed in a single piece and will be used to deliver small satellites into orbit.