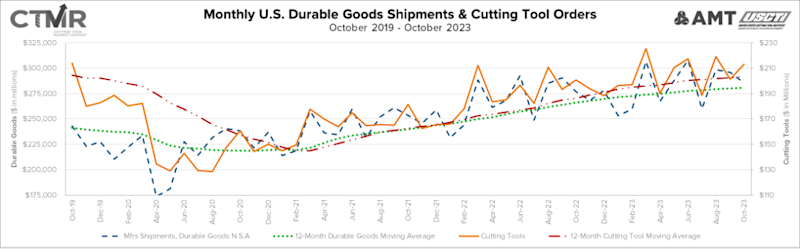

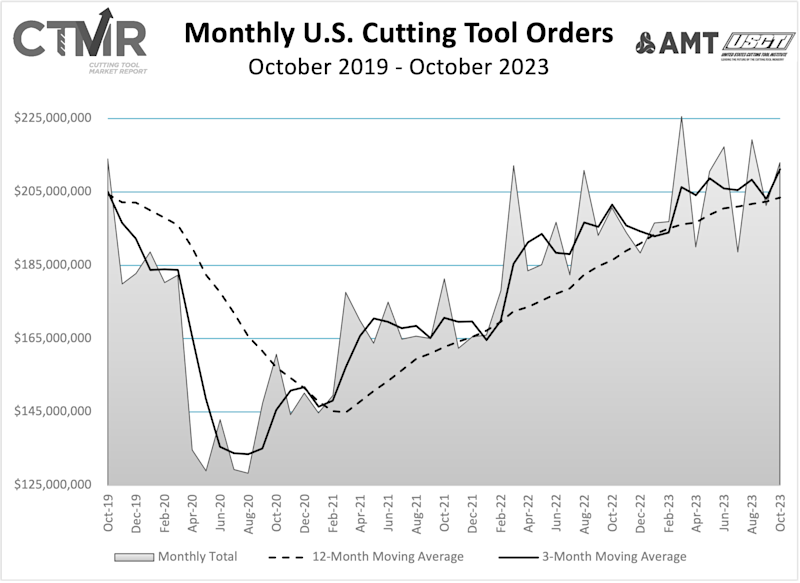

McLean, Va. (December 13, 2023) — October 2023 U.S. cutting tool consumption totaled $213 million, according to the U.S. Cutting Tool Institute (USCTI) and AMT – The Association For Manufacturing Technology. This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was up 5.8% from September’s $201.4 million and up 6.1% when compared with the $200.6 million reported for October 2022. With a year-to-date total of $2.06 billion, 2023 is up 7.9% when compared to the same time period in 2022.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools.

“U.S. cutting tool orders continued to show a trend of uneven growth over the last quarter, and we expect that narrative to continue through the first half of next year,” remarked Steve Boyer, president of USCTI. “Aerospace and automotive market indicators show sustained growth for 2024 and 2025. Other industrial market segments have softened over the last six months, and we anticipate some decline into the next year. Labor shortages, retention challenges, and an aging workforce will challenge future growth in our markets.”

Eli Lustgarten, president at ESL Consultants, expanded: “Current U.S. cutting tool consumption data remains relatively strong despite the ongoing softness of U.S. manufacturing. Cutting tools are one of the last manufacturing sectors to return to pre-COVID levels. Indications are that conditions will be uncertain for the remainder of 2023 and into 2024. The ISM reported that November manufacturing in the United States contracted for the 13th consecutive month as the U.S. economy slowed under the pressure of higher rates and a consumer slowdown. With the unknown impact of current global turmoil and manufacturing inventories at normal levels or higher, customer orders are being delayed, and companies are focusing on right-sizing inventories. Sustaining current production levels near-term will be difficult. We expect cutting tool orders to remain firm, with 2023 orders of about $2.4 billion to $2.45 billion, likely about 6% to 7% above last year’s level. The first half of 2024 will likely be challenging; a soft economic landing with lower rates will help stabilize and enhance growth next year. The wild card is international turmoil.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Historical data for the Cutting Tool Market Report is available dating back to January 2012. This collaboration of AMT and USCTI is the first step in the two associations working together to promote and support U.S.-based manufacturers of cutting tool technology.

The graph below includes the 12-month moving average for the durable goods shipments and cutting tool orders. These values are calculated by taking the average of the most recent 12 months and plotting them over time.

# # #

AMT – The Association For Manufacturing Technology represents and promotes U.S.-based manufacturing technology and its members – those who design, build, sell, and service the continuously evolving technology that lies at the heart of manufacturing. Founded in 1902 and based in Virginia, the association specializes in providing targeted business assistance, extensive global support, and business intelligence systems and analysis. AMT is the voice that communicates the importance of policies and programs that encourage research and innovation, and the development of educational initiatives to create tomorrow’s Smartforce. AMT owns and manages IMTS – The International Manufacturing Technology Show, which is the premier manufacturing technology event in North America.

The United States Cutting Tool Institute (USCTI) was formed in 1988 and resulted from a merger of the two national associations representing the cutting tool manufacturing industry. USCTI works to represent, promote, and expand the U.S. cutting tool industry and to promote the benefits of buying American-made cutting tools manufactured by its members. The Institute recently expanded its by-laws to include any North American manufacturer and/or remanufacturer of cutting tools, as well as post-fabrication tool surface treatment providers. Members, which number over 80, belong to seven product divisions: Carbide Tooling, Drill & Reamer, Milling Cutter, PCD & PCBN, Tap & Die, Tool Holder and All Other Tooling. A wide range of activities includes a comprehensive statistics program, human resources surveys and forums, development of product specifications and standards, and semi-annual meetings to share ideas and receive information on key industry trends.

# # #