The lack of focus on manufacturing over the past 40 years has increased United States dependence on imports so much that it needed hundreds of billions of dollars in government incentives to accelerate the recovery. It is imperative that the manufacturing industrial base maintain a strong recovery to return this country to a safer and more self-sufficient state. Government incentives are playing an important role in strengthening manufacturing and reducing the U.S. reliance on imports.

High-ranking reshoring influencers Government incentives rank high in the factors influencing reshoring decisions. They, along with skilled workforce availability, local sourcing (supply chain interruption risk, proximity to customers/market and ecosystem), and infrastructure highlight the core issues influencing reshoring. In the last year or two, geopolitical risk has achieved an equally high rank.

New investments in U.S. manufacturing by domestic and foreign companies have accelerated even more than anticipated, largely due to three bills designed to fuel growth, de-risk vulnerable supply chains, manage the threat of climate change, boost competitiveness, and provide well-paying jobs for U.S. workers.

Modern day gold rush The $280 billion Chips and Science Act , the $369 billion Inflation Reduction Act and the $1.2 trillion Bipartisan Infrastructure Bill are investments in our national and energy security and our economic competitiveness. Some are calling it a “modern-day gold rush” driven by incentives and new technologies. Semiconductor chips are being hailed the “new oil.” Green energy investment in the U.S. from domestic and foreign companies is surging.

The Chips Act - manufacturing ecosystems Since the Chips Act’s introduction in June 2020, semiconductor companies have announced in total over $231 billion in commitments in semiconductor and electronic investments creating tens of thousands of well-paying jobs in the semiconductor ecosystem. In addition, about 50 community colleges in 19 states have announced new or expanded training for the semiconductor workforce.

The legislation is set to give semiconductor companies $52.7 billion in targeted funds from the Chips Act to establish at least two manufacturing ecosystem clusters for leading-edge semiconductors by 2030. The clusters would include fabrication plants, R&D labs, final packaging facilities for assembly, and the suppliers needed to support the environs. Will your company be a part of the ecosystems?

Manufacturing ecosystems or clusters, “the concentration of specialized industries in particular localities,” offer a competitive advantage. Clusters encourage local universities to collaborate with regional companies to supply specialized training to support growth. Suppliers’ close proximity to consumers and markets provides cost advantages and efficiencies for transportation, supply chains, and logistics. The competitive advantage enables more reshoring and foreign direct investment (FDI). Successful cluster examples include Silicon Valley, where chip technology emerged, and the network of biotech firms established around the Massachusetts Institute of Technology (MIT) and Harvard University. Information on CHIPS Act funding opportunities is available from NIST.

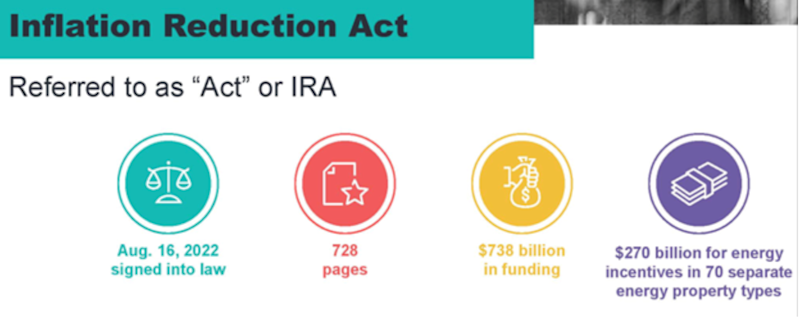

Figure 1: Inflation Reduction Act (IRA).

The Inflation Reduction Act is the most significant energy incentive legislation in U.S. history. The IRA promotes energy transition through funding, programs, and incentives to accelerate a clean energy economy. The IRA provides tax credits for manufacturers that can be used against their own tax liability or transferred (sold) to another taxpayer.Source: Bakertilly: “Inflation Reduction Act: What Manufacturers Need To Know”

Although the original IRA announcement estimated that uncapped subsidies over 10 years would be $369 billion, new Goldman Sachs research estimates that the IRA’s impact could reach $1.2 trillion and attract $3 trillion in investment by industry. As of this writing, there are 272 new or expanded clean energy manufacturing projects in the United States, including 91 in batteries, 65 in electric vehicles, and 84 in wind and solar power.

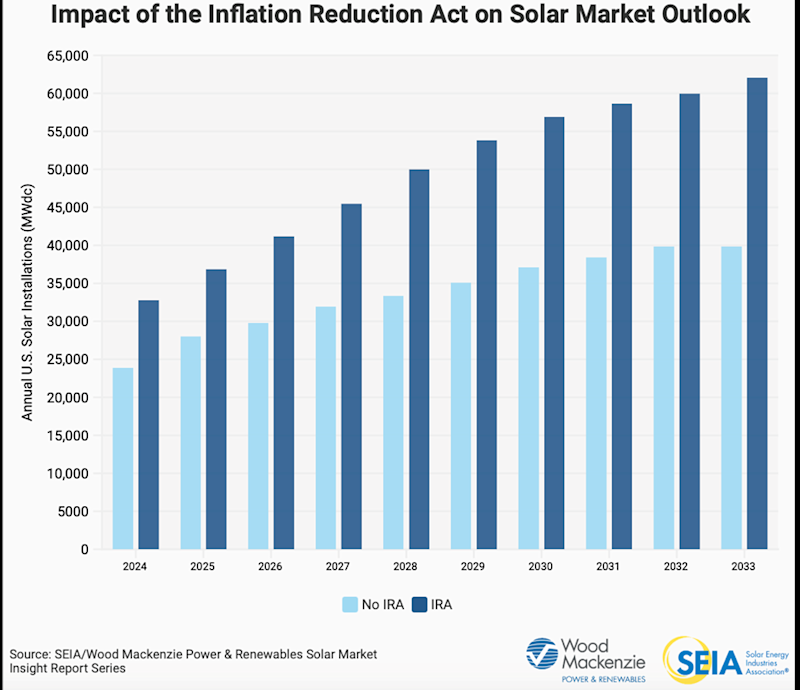

Success of the IRA can be seen in the U.S. solar industry which has added $100 billion in private investments with 51 manufacturing facilities announced or expanded in the last year.

Figure 2: SEIA/Wood Mackenzie Power & Renewables Solar Market Insight Report Series

Additional information on IRA incentive programs is available from several sources, including NIST, an excellent webinar by auditing and consulting firm Baker Tilly, and an AMT webinar.

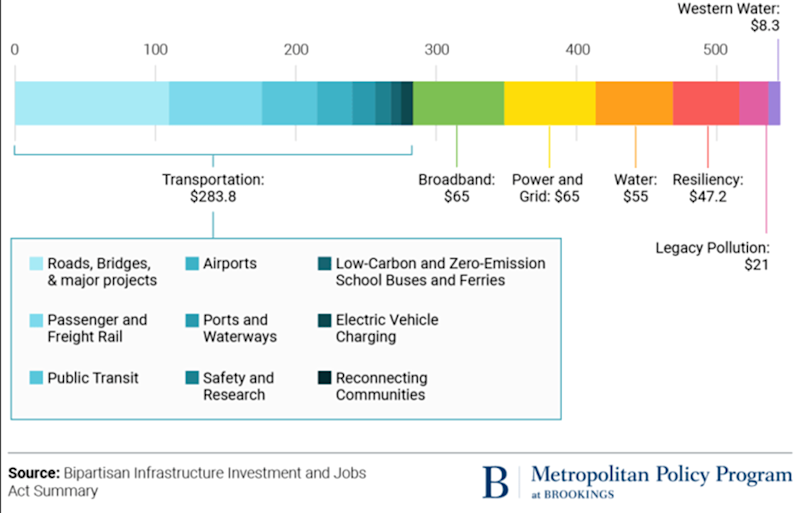

The Infrastructure Investment and Jobs Act (IIJA) The bipartisan IIJA is an investment in U.S. competitiveness. Key takeaways include abundant opportunities for manufacturers due to the sheer size of the bill; hundreds of millions of dollars toward workforce training; renovated and expanded roads, airports and ports mitigating supply chain bottlenecks and providing access to new talent pools; and encouraging reshoring through increased global competitiveness as companies look to shorten supply chains.

Top line above-baseline spending in IIJA (billions of USD)

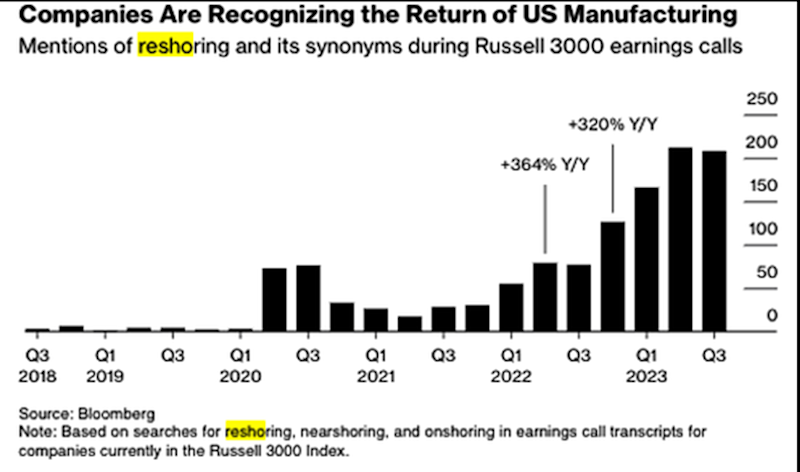

Globalization is slowing, reshoring is on the rise There is broad consensus that globalization is slowing as global trade volumes decline and cross-border capital flows recede. According to Bloomberg data, U.S. company mentions of “reshoring,” “onshoring,” or “nearshoring,” in third-quarter earnings calls jumped 216% year-over-year since the beginning of 2022.

Figure 4: Bloomberg and Zero Hedge

Are you thinking about reshoring?

Presently, shifting forces are creating more incentives and opportunities for companies to produce at home. Growing geopolitical uncertainty is driving companies to reshore additional product categories. Increased nearshoring of work from Asia to Mexico has a positive impact as imports from Mexico will require about 40% U.S. value added vs. 5% for imports from China. We expect 2023 and 2024 to remain strong, continuing at approximately 350,000 job announcements per year. For help reshoring, contact me at 847-867-1144 or email me at harry.moser@reshorenow.org.