April 13, 1970, 9:07 a.m. The crew of Apollo 13 hears “bang-whump-shudder” and then a chorus of alarms.

An explosion in the oxygen tanks critically damages the main engine. Over 200,000 miles away, NASA Mission Control in Houston scrambles to diagnose and fix a problem that neither they nor the crew can see.

Luckily, we know how this story ends.

NASA’s 15 simulators, used to train and prepare Apollo 13 for every kind of issue, became the proving grounds for the first digital twin and played a critical role in saving the astronauts.

Today, in advanced manufacturing, the technology offers optimization, speed, and a lot more.

More Than a Model

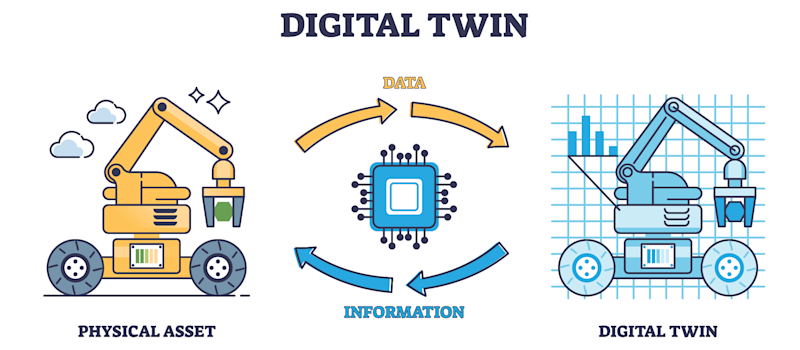

A digital twin is more than a computer approximation or simple 3D model – it is an ever-evolving, data-driven digital representation of a system. NASA’s physical simulators have now been replaced by fully virtual spaces where sensor information fills in the details, with no guesswork needed.

Digital twins use real-time data aggregation and processing to simulate – or “twin” – a system, providing users with a non-destructive sandbox that mirrors physical assets. Given enough computing power, their scale can span from individual serial numbers to entire business ecosystems.

The technology is tied to the Industrial Internet of Things, cloud computing, extended reality, and artificial intelligence. In fact, it is only possible thanks to these other tools, as the systems require in-situ sensor data, immense off-site server resources, and the algorithms to transform it all into something useful.

And just like these other tools, digital twin technology is still emerging and maturing, with different sectors harvesting its value in bespoke ways.

Twinning Is Winning

Manufacturing leads the charge for digital twin adoption. The global market size for digital twins in the manufacturing industry was just $590 million in 2020. It is expected to grow to $6.69 billion in 2025. Manufacturing shows the highest jump out of five other industries: automotive, aviation, energy and utilities, health care, and logistics/retail markets, but all show considerable global growth.

MarketsandMarkets reported in 2023 that “North America is expected to hold the largest share of the digital twin market throughout 2023-2028.” This is due in part to the region’s “technologically mature ecosystem with robust digital infrastructure, advanced data analytics capabilities, and a skilled workforce.”

The increase in digital twins can be attributed to key enablers of automation laying the groundwork. These include better inspection tools, industrial robotics, data storage improvements, and more effective model correlation and simulation software.

A July 2023 report from McKinsey & Co. stated that “in advanced industries, almost 75 percent of companies have already adopted digital-twin technologies that have achieved at least medium levels of complexity.”

Opportunities and Barriers

Thanks to integrated and scalable data systems, opportunities exist for small shops or contract manufacturers in digital twin technology.

Generating models of every part that leaves a shop becomes a second asset. Contractors can sell the digital representation of their parts as a value-added service, helping to improve the larger company’s digital twin. More than that, shops can increase their throughput by using this technology to optimize their spaces just as larger smart factories do.

But there are also challenges. That same 2023 McKinsey & Co. report stated: “Players in the automotive – and aerospace and defense – industries appear to be more advanced in their use of digital twins today, while logistics, infrastructure, and energy players are more likely to be developing their first digital-twin concepts.”

Furthermore, a 2020 NIST study on five OEM and SME companies in the automotive and heavy vehicles supply chain concluded that “Organizational, information silos and lack of knowledge of the physical world are obstacles for digital-twin development.”

It went on: “Many of the case companies are SMEs without their own IT departments. Therefore, to proceed with this digital-twin concept, they would need to learn more about it and understand the resources (including IT resources) required to implement that concept.”

Fully fleshed-out digital twins are still a premium technology; this is illustrated through the top five key market players: General Electric, Microsoft, Siemens, Amazon Web Services, and ANSYS, all of which have multibillion-dollar market caps.

Invisible Twin

Like Bluetooth or high-speed Wi-Fi, this technology aims to be invisible, non-intrusive, and ubiquitous. In advanced manufacturing, we will see more sensor integration into systems that will help data aggregation efforts to build these twins.

Take metal 3D printers, for example: In-situ monitoring within metal 3D printers collects readings from every single powder layer deposited. This layer-by-layer observation builds a high-fidelity representation of the part’s defects while removing the need for non-destructive testing methods like CT scans.

The ASTM International Center of Excellence, in their Additive Manufacturing In-Situ Monitoring Technology Readiness Strategic Guide, reports the most mature aspects of this technology:

Layer Imaging: “In PBF-LB and DED processes, off-axis cameras can be used to image and assess the quality of the top layer of the powder bed. This method allows monitoring of the entire build area for anomalies such as short feed, high spots, and more. Layer imaging is already being included in many commercial systems and is also being offered by several OEMs as an upgrade to already-installed machines.”

Residual Stress and Distortion Models: “Models to predict and systems to monitor distortion effects due to residual stress have been demonstrated to be accurate at prediction, detection, and mitigation. This capability is already included in commercial software packages and systems.”

Case Study: Digital-First EV Factory

When implemented fully, digital twins unlock the purchasing of hardware beyond the hypothetical, letting businesses rearrange floorplans or optimize floor cell designs with little guesswork.

GPU giant Nvidia is helping automaker BMW Group transform its newest production network into a digital-first, entirely virtual factory. Powered by their Omniverse Enterprise, BMW’s electric vehicle plant in Debrecen, Hungary, is being built virtually before its opening in 2025.

Nvidia describes it: “With Omniverse, the BMW team can aggregate data into massive, high-performance models, connect their domain-specific software tools, and enable multi-user live collaboration across locations. All of this is possible from any location, on any device. Starting to work in the virtual factory two years before it opens enables the BMW Group to ensure smooth operation and optimal efficiency.

And the benefits are also monetary: “Putting in change orders and flow reoptimizations on existing facilities is extremely costly and causes production downtime. So having the ability to pre-optimize virtually eliminates such costs.”

Key Points

Digital twins leverage computation and integrated data collection technology to create a robust framework for advanced manufacturing. Here are the main takeaways for manufacturers interested in the technology:

Digital twins use real-time data to evolve, matching the physical system as closely as possible. This allows for fully virtual process optimization, diagnostics, and design with near-infinite freedom.

The manufacturing industry is one of the fastest-growing spaces for digital twins.

Smaller manufacturers have much to gain from the technology, given they have the IT resources and knowledge base to deploy them.

Toolmakers are helping to close this gap by including these resources in equipment, such as metal 3D printers with imaging and predictive modeling support, which are available today.

Nvidia’s work on BMW’s EV plant shows where advanced manufacturing is going and how all aspects of the supply chain will integrate into the process.

To read the rest of the Digital Manufacturing Issue of MT Magazine, click here.