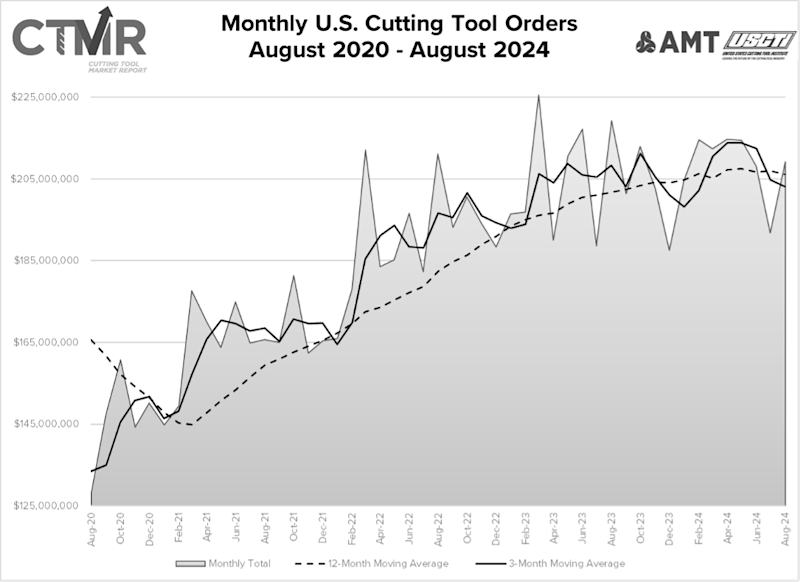

McLean, Va. (October 16, 2024) — Shipments of cutting tools, measured by the Cutting Tool Market Report compiled in a collaboration between AMT – The Association For Manufacturing Technology and the U.S. Cutting Tool Institute (USCTI), totaled $209.3 million in August 2024. Orders increased 9.1% from July 2024 but were down 4.5% from August 2023. Year-to-date shipments totaled $1.67 billion, up 1.5% from shipments made in the first eight months of 2023. The year-to-date growth rate has declined every month since April 2024.

“U.S. cutting tool orders have hit significant headwinds as we move into the fourth quarter of 2024,” said Steve Boyer, president of USCTI. “We saw drop-offs in orders for two of the last three months of the third quarter of this year compared to last year. Challenges continue with work stoppages in the aerospace sector. Instability in world events is also significantly impairing market confidence as we finish out 2024. Defense spending continues to be strong, while other markets have shown some stagnation. Early expectations for continued growth in 2025 originally showed promise, but a lackluster 2025 is probably more realistic with so many factors in flux.”

Bret Tayne, president of Everede Tool Company, said: “Sales of industrial metal cutting tools seems to have plateaued. We can look past some of the ‘noise’ by focusing on the 12-month moving average, and that is flat. This conclusion seems to be consistent with what we read about the broader economy. We are at an inflection point. Some macro data points to a recession, and other data indicates we may avoid it. From the perspective of our industry, it will be interesting to see if we achieve any sustainable momentum from IMTS, which took place in September.”

IMTS – The International Manufacturing Technology Show was held Sept. 9-14 in Chicago. A biennial event produced by AMT, IMTS is the largest manufacturing trade show in the Western Hemisphere and regularly provides a boost to manufacturing technology and machine tool orders across all sectors.

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process, the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

# # #

AMT – The Association For Manufacturing Technology represents and promotes U.S.-based manufacturing technology and its members – those who design, build, sell, and service the continuously evolving technology that lies at the heart of manufacturing. Founded in 1902 and based in Virginia, the association specializes in providing targeted business assistance, extensive global support, and business intelligence systems and analysis. AMT is the voice that communicates the importance of policies and programs that encourage research and innovation, and the development of educational initiatives to create tomorrow’s Smartforce. AMT owns and manages IMTS – The International Manufacturing Technology Show, which is the premier manufacturing technology event in North America.

The United States Cutting Tool Institute (USCTI) was formed in 1988 and resulted from a merger of the two national associations representing the cutting tool manufacturing industry. USCTI works to represent, promote, and expand the U.S. cutting tool industry and to promote the benefits of buying American-made cutting tools manufactured by its members. The Institute recently expanded its bylaws to include any North American manufacturer and/or remanufacturer of cutting tools, as well as post-fabrication tool surface treatment providers. Members, which number over 80, belong to seven product divisions: Carbide Tooling, Drill & Reamer, Milling Cutter, PCD & PCBN, Tap & Die, Tool Holder and All Other Tooling. A wide range of activities includes a comprehensive statistics program, human resources surveys and forums, development of product specifications and standards, and semi-annual meetings to share ideas and receive information on key industry trends.

# # #