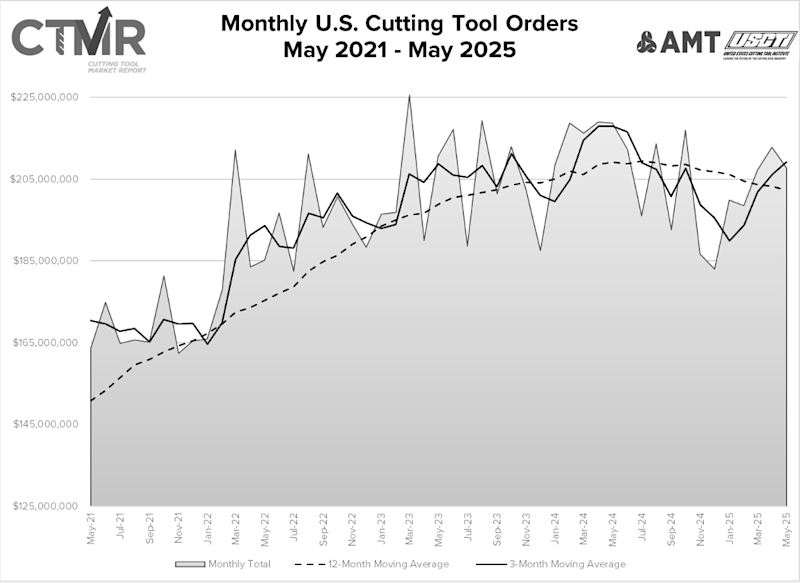

McLean, Va. (July 21, 2025) — Shipments of cutting tools, measured by the Cutting Tool Market Report compiled in a collaboration between AMT – The Association For Manufacturing Technology and the U.S. Cutting Tool Institute (USCTI), totaled $207.8 million in May 2025. Orders decreased 2.3% from April 2025 and 5% from May 2024. Year-to-date shipments totaled $1.03 billion, a drop of 5.1% from the same period in 2024.

“This summer, everyone is playing wait and see,” said Jack Burley, chairman of AMT’s Cutting Tool Product Group. “No one is investing in new production unless they have the security of a long-term project, such as for the defense industry, where cost is less important than delivery. Demand from the automotive market is weak, and the supply chain is getting squeezed by tariffs while vehicle manufacturers protect their bottom line. When we closely check the cutting tool data, unit cost appears to have increased slightly since January, most likely due to price increases. However, it’s too early to establish a trend with variables like surcharges to know the real costs. I don’t know who will win the wait-and-see game, but I hope it works out for everyone soon.”

Costikyan Jarvis, president of Jarvis Cutting Tools, said: “Sales of cutting tools through May reveal a controlled retreat rather than a collapse. The 5% drop in year-over-year numbers is consistent with the PMI falling below 50 from March through May. Taken in context with other financial metrics like capacity utilization, new vehicle sales, and civilian aircraft production, the second half of this year will likely see a rebound in demand. In short, the cutting tool market remains under pressure, but forward-looking industrial indicators hint that the worst of the pullback may be passing.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process, the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

AMT – The Association For Manufacturing Technology represents U.S.-based providers of manufacturing technology – the advanced machinery, devices, and digital equipment that U.S. manufacturing relies on to be productive, innovative, and competitive. Located in McLean, Virginia, near the nation’s capital, AMT acts as the industry’s voice to accelerate the pace of innovation, increase global competitiveness, and develop manufacturing’s advanced workforce of tomorrow. With extensive expertise in industry data and market intelligence, as well as a full complement of international business operations, AMT offers its members an unparalleled level of support. AMT also produces IMTS – The International Manufacturing Technology Show, the premier manufacturing technology event in North America. Learn more at AMTonline.org.

The United States Cutting Tool Institute (USCTI) was formed in 1988 and resulted from a merger of the two national associations representing the cutting tool manufacturing industry. USCTI works to represent, promote, and expand the U.S. cutting tool industry and to promote the benefits of buying American-made cutting tools manufactured by its members. The Institute recently expanded its by-laws to include any North American manufacturer and/or remanufacturer of cutting tools, as well as post-fabrication tool surface treatment providers. Members, which number over 80, belong to seven product divisions: Carbide Tooling, Drill & Reamer, Milling Cutter, PCD & PCBN, Tap & Die, Tool Holder and All Other Tooling. A wide range of activities includes a comprehensive statistics program, human resources surveys and forums, development of product specifications and standards, and semi-annual meetings to share ideas and receive information on key industry trends.

# # #