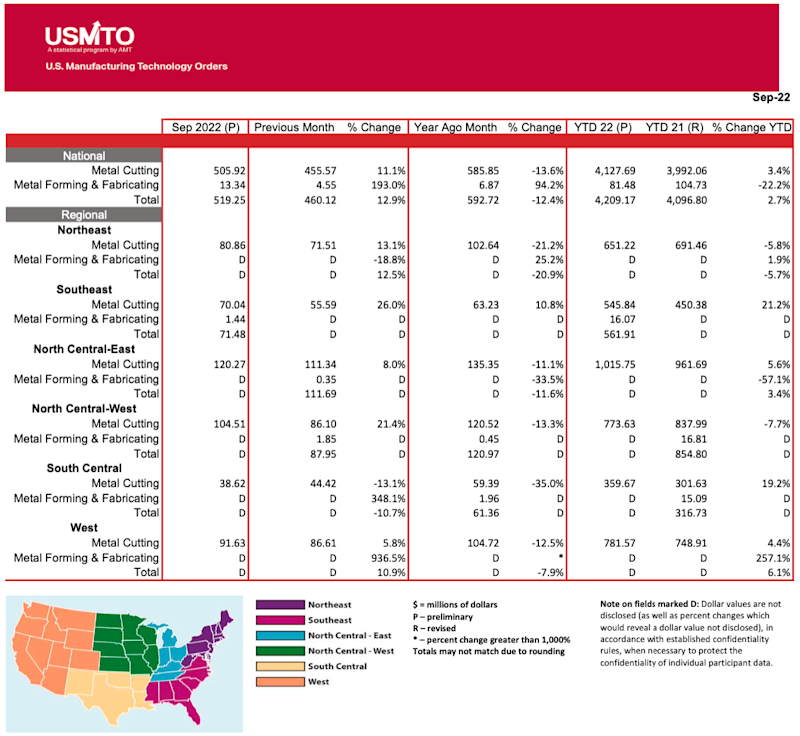

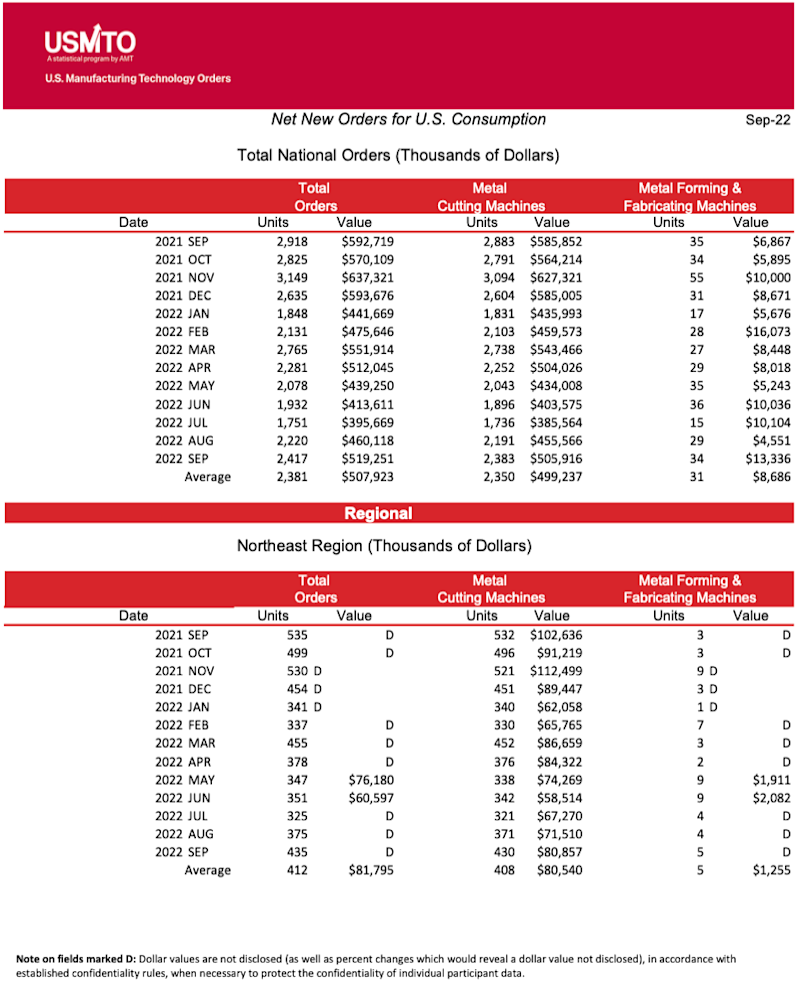

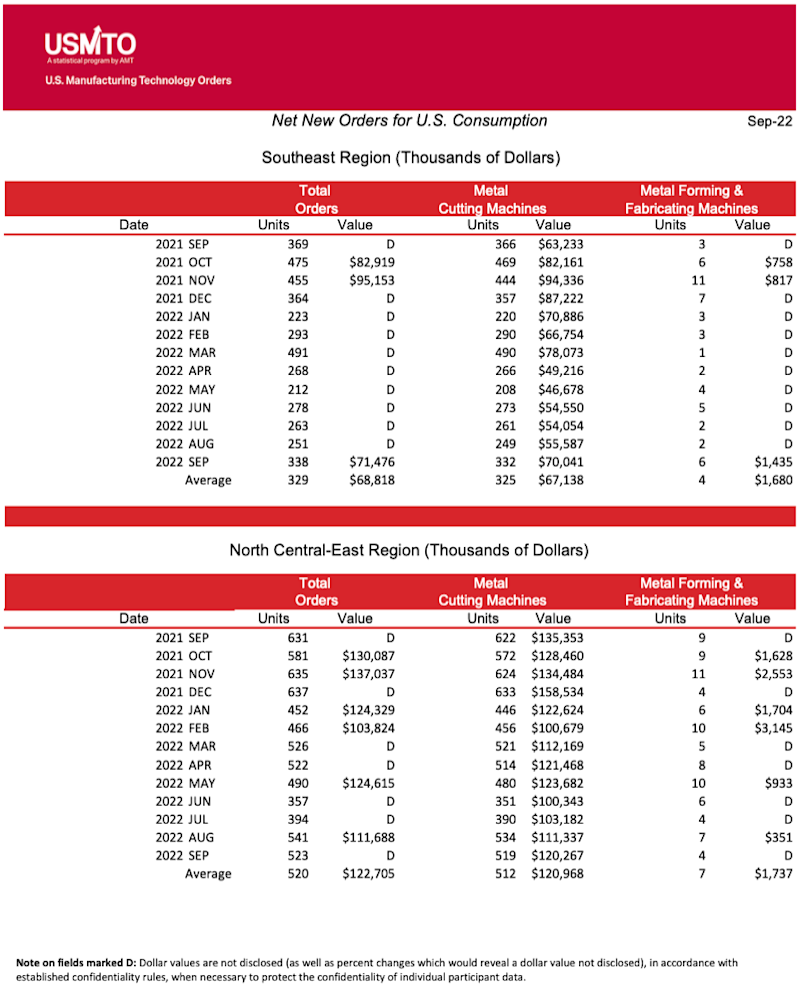

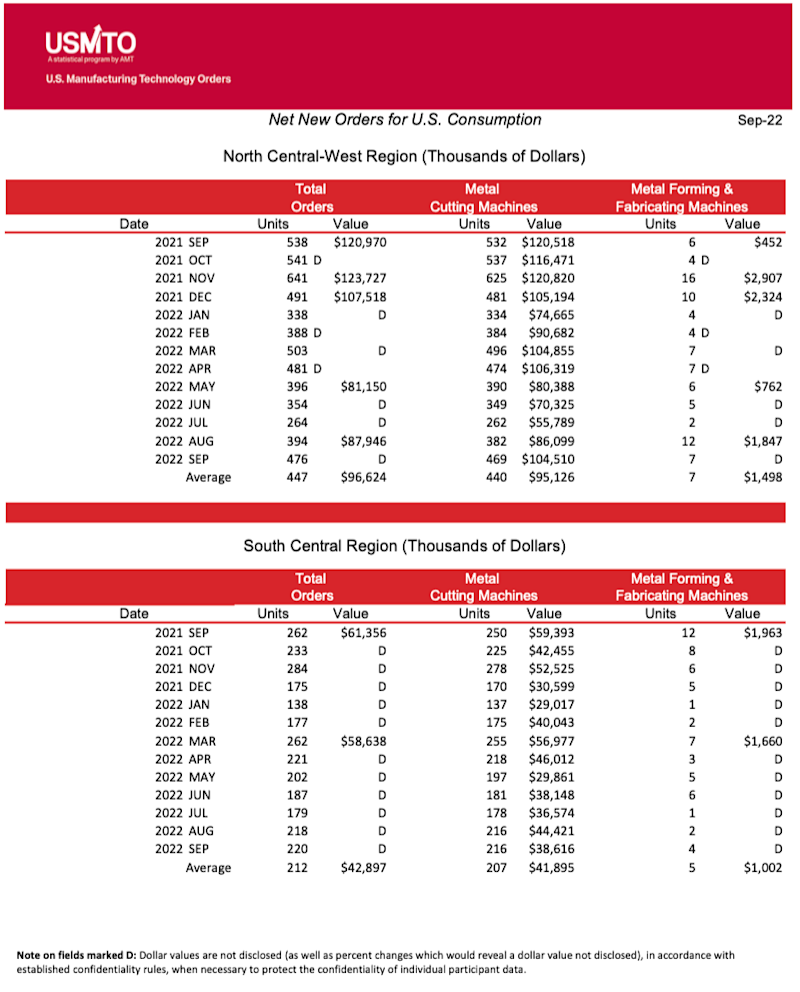

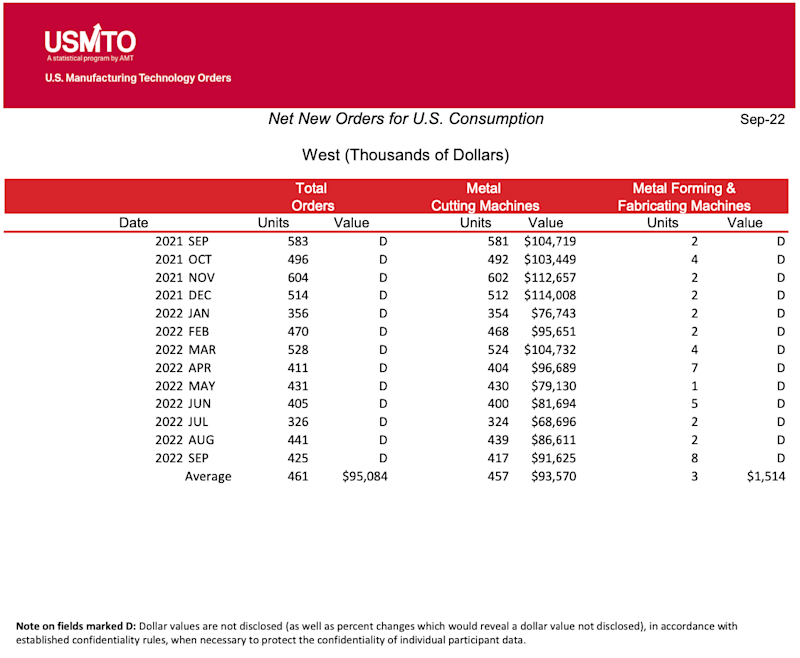

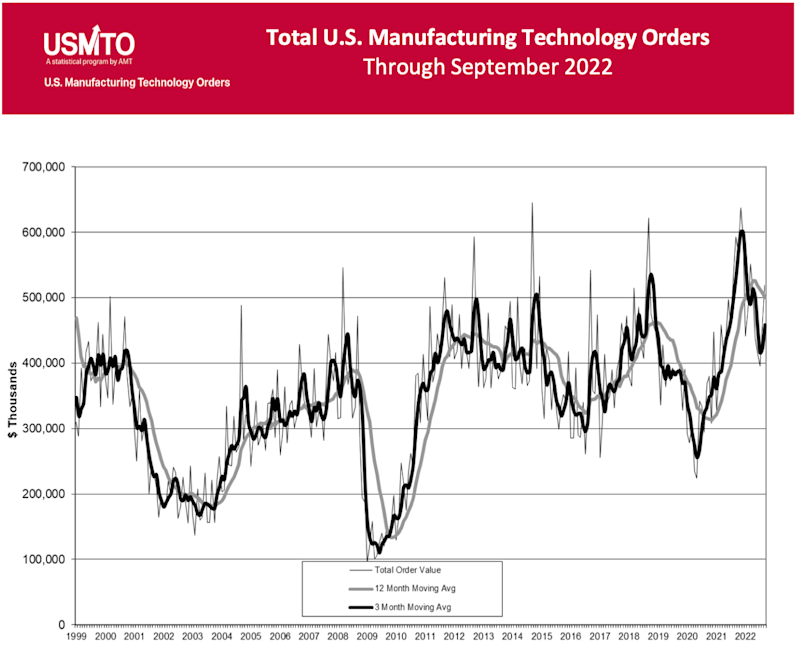

McLean, Va. (November 14, 2022) – New orders of manufacturing technology totaled $519.3 million in September 2022, according to the latest U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology. September 2022 orders were up just under 13% from August 2022 but down 12.4% from September 2021, marking the first time an IMTS September had a lower order value than the year prior. Total orders in 2022 reached $4.2 billion, an increase of 2.7% over the first three quarters of 2021.

“We’re seeing the typical bump in orders brought on by IMTS and ‘the IMTS effect,’ but orders throughout 2022 are expected to fall short of 2021 order levels – the largest year in the program’s history,” said Pat McGibbon, chief knowledge officer at AMT. “The backlogs built over the last 18 months have lengthened delivery times and weigh on the decision to continue investing in additional equipment.”

Demand for additional domestic capacity and augmenting current production lines with automation has driven orders. In September 2022, that was particularly apparent in orders for forming and fabricating machinery. Appliance imports have fallen by nearly one-third but largely because of supply challenges, not a lack of demand. Appliance and HVAC manufacturers are increasing domestic capacity to bridge this gap, and that can be seen in the USMTO data. Supply chains for the aerospace sector are continuing to increase domestic capacity, particularly for cutting equipment, in an attempt to reduce reliance on foreign components. Likewise, manufacturers of agricultural equipment are continuing their investments in capital equipment. The agricultural sector has been feeling the brunt of recent labor shortages, which has necessitated the investment in more efficient, automated machinery. Additionally, with the growing unpredictability of Ukrainian grain exports, more reliance has been placed on expanded U.S. production.

Despite the anticipated slowing economy as 2022 closes and 2023 begins, the manufacturing sector remains humming at near-full capacity. “Quotations remain high, and anecdotally, we’re hearing that demand from our customer industries is not slowing,” said McGibbon. “While signs are positive now, we do expect orders to be softer the remainder of the year for most production equipment – with the exception of advanced and automation technologies. These technologies are in high demand to address the tighter labor market and increasing productivity of existing capacity. Also, continued efforts by North American manufacturers to increase their regional supply chain will continue to mitigate the modest decline in demand for durable goods. The softer order levels will provide the opportunity for manufacturing technology providers to convert their backlogs into shipped orders.”

# # #

The United States Manufacturing Technology Orders (USMTO) Report is based on the totals of actual data reported by companies participating in the USMTO program. This report, compiled by AMT – The Association For Manufacturing Technology, provides regional and national U.S. orders data of domestic and imported machine tools and related equipment. Analysis of manufacturing technology orders provides a reliable leading economic indicator as manufacturing industries invest in capital metalworking equipment to increase capacity and improve productivity.

AMT – The Association For Manufacturing Technology represents U.S.-based providers of manufacturing technology – the advanced machinery, devices, and digital equipment that U.S. manufacturing relies on to be productive, innovative, and competitive. Located in McLean, VA, near the nation’s capital, AMT acts as the industry’s voice to speed the pace of innovation, increase global competitiveness, and develop manufacturing’s advanced workforce of tomorrow. With extensive expertise in industry data and intelligence, as well as a full complement of international business operations, AMT offers its members an unparalleled level of support. AMT also produces IMTS – The International Manufacturing Technology Show, the premier manufacturing technology event in North America. www.amtonline.org

IMTS – International Manufacturing Technology Show - The largest and longest-running manufacturing technology trade show in the United States is held every other year at McCormick Place in Chicago, Ill. IMTS 2024 will run Sept. 9-14, 2024. IMTS is ranked among the largest trade shows in the world. Recognized as one of the world’s preeminent stages for introducing and selling manufacturing equipment and technology as well as connecting the industry’s supply chain. IMTS attracts visitors from every level of industry and more than 117 countries. IMTS 2018 was the largest in number of registrations (129,415), net square feet of exhibit space (1,424,232 sq. ft.), booths (2,123) and exhibiting companies (2,563). IMTS is owned and managed by AMT – The Association For Manufacturing Technology. www.IMTS.com