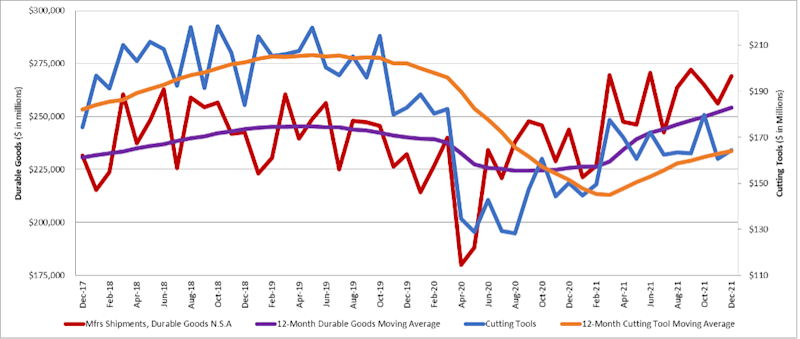

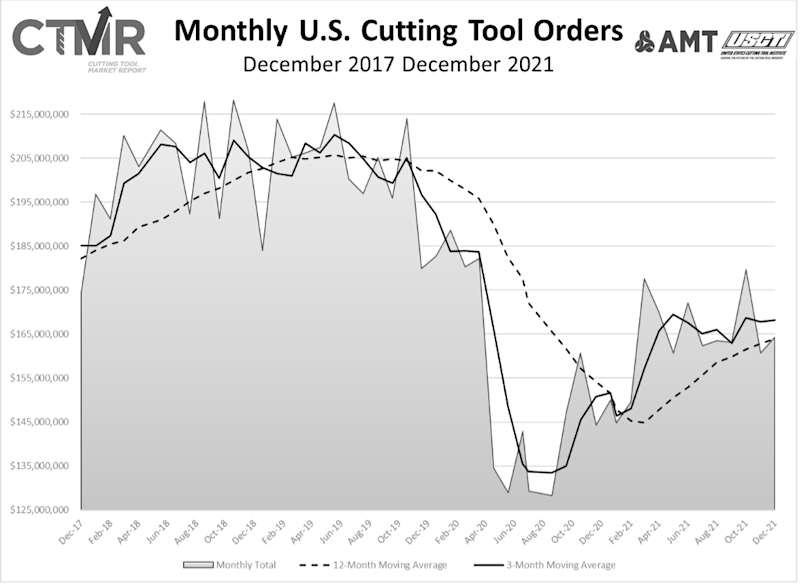

McLean, Va. (February 14, 2022) – December 2021 U.S. cutting tool consumption totaled $164.3 million, according to the U.S. Cutting Tool Institute (USCTI) and AMT – The Association For Manufacturing Technology. This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was up 2.2% from November's $160.7 million and up 9.5% when compared with the $150.1 million reported for December 2020. With a year-to-date total of nearly $2.0 billion, 2021 is up 8.3% when compared to the same time period in 2020.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools.

Jeff Major, president of USCTI, commented, “The cutting tool industry continues to rebound from the pandemic's impact in 2020. Projections for 2022 are positive for the industry, with expectations of a full recovery to pre-pandemic levels in 2023. With that said, we still face headwinds from inflation, supply chain disruptions, and problems with workforce hiring and retention.”

Bret Tayne, president of Everede Tool Company, also spoke on the difficulties that the cutting tool industry might face, saying, “December cutting tool sales data continue to show a moderate upward trend. Year over year and YTD sales continued to improve at a pace similar to the prior three months but at a slower pace than we experienced for April through August. It will be interesting to see how developments in January, such as the widespread increase in Omicron variant cases and Federal Reserve announcements on policy shifts, affect the next data set.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Historical data for the Cutting Tool Market Report is available dating back to January 2012. This collaboration of AMT and USCTI is the first step in the two associations working together to promote and support U.S.-based manufacturers of cutting tool technology.

The graph below includes the 12-month moving average for the durable goods shipments and cutting tool orders. These values are calculated by taking the average of the most recent 12 months and plotting them over time.

# # #

AMT – The Association For Manufacturing Technology represents and promotes U.S.-based manufacturing technology and its members – those who design, build, sell, and service the continuously evolving technology that lies at the heart of manufacturing. Founded in 1902 and based in Virginia, the association specializes in providing targeted business assistance, extensive global support, and business intelligence systems and analysis. AMT is the voice that communicates the importance of policies and programs that encourage research and innovation, and the development of educational initiatives to create tomorrow’s Smartforce. AMT owns and manages IMTS – The International Manufacturing Technology Show, which is the premier manufacturing technology event in North America.

The United States Cutting Tool Institute (USCTI) was formed in 1988 and resulted from a merger of the two national associations representing the cutting tool manufacturing industry. USCTI works to represent, promote, and expand the U.S. cutting tool industry and to promote the benefits of buying American-made cutting tools manufactured by its members. The Institute recently expanded its by-laws to include any North American manufacturer and/or remanufacturer of cutting tools, as well as post-fabrication tool surface treatment providers. Members, which number over 80, belong to seven product divisions: Carbide Tooling, Drill & Reamer, Milling Cutter, PCD & PCBN, Tap & Die, Tool Holder and All Other Tooling. A wide range of activities includes a comprehensive statistics program, human resources surveys and forums, development of product specifications and standards, and semi-annual meetings to share ideas and receive information on key industry trends.

# # #