Since its launch in April 2022, Subcity.com has helped California manufacturers collect $19 million in tax credits and incentives, and now those opportunities are being extended to Ohio manufacturers as well.

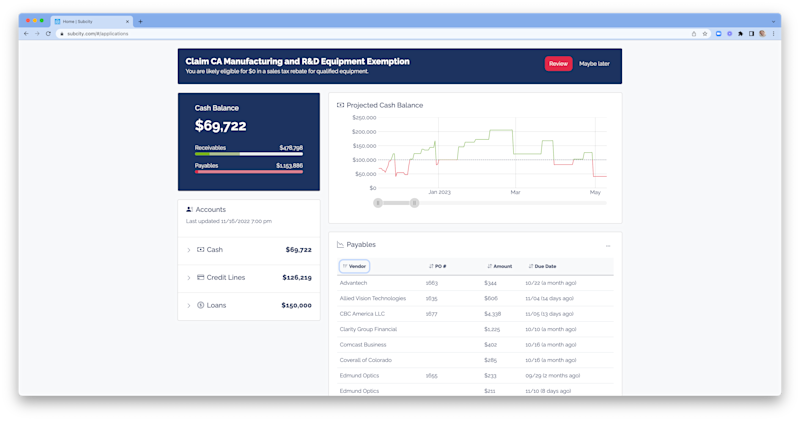

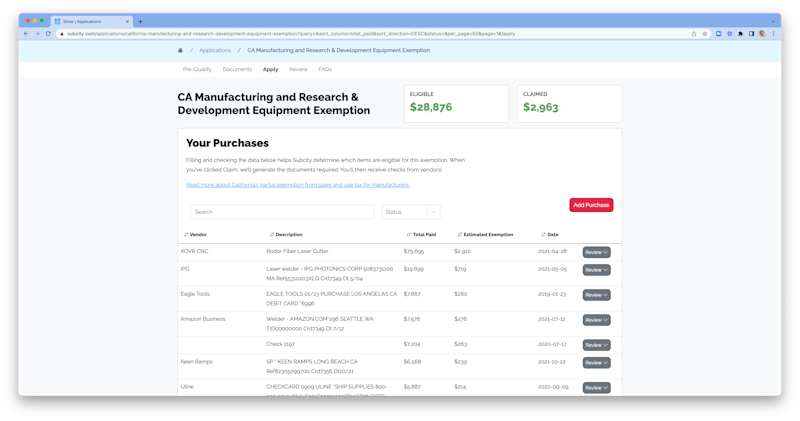

When California manufacturers fill out an application on the Subcity website, they receive a personalized list of economic incentives and tax credits for which they may be eligible. Subcity experts can help administer applications to make the process fast and easy for manufacturers to get funding that can help them succeed. Learn more about how Subcity works in this recent article.

To date, 30 California manufacturers, such as Justice Design Group and Versa Products, have used the website to receive funding that they otherwise might not have known about. As manufactures are learning about programs that they were eligible for in past years, Subcity is helping clients go back as far as three years to retroactively claim funding.

“In the last few months, we’ve learned that there are a lot more funds available for manufacturers than we ever imagined,” Alex White, co-founder of Subcity, says. “Tax credits for employee retention and R&D tax in particular have surprised us with their big payouts.”

Federal and State Funds

White has noticed that the majority of funding being paid out in California is from five different programs:

Partial Sales Tax Exemption - California manufacturers don’t pay state sales tax on equipment used for manufacturing and R&D. Subcity clients have been receiving $10,000 to $80,000 for this exemption alone.

California Competes State Tax Credit- Qualified businesses must be located in California and hire labor, purchase equipment, and invest in real estate over a five-year period.

Federal R&D Tax Credit - Incentivizes companies to invest in research and development. Manufacturers doing even a little experimenting or investing in research may be eligible.

Federal Employee Retention Tax Credit - This is for manufacturers that suffered a revenue decline due to COVID but still retained their employees from 2019 to 2021.

Economic Development Rate Discount - Major California utilities such as PG&E, Southern California Edison, and SMUD offer a lower utility rate for business with power as a key cost, sometimes resulting in a 12 to 25% reduction in the monthly utility bill.

Ohio and Beyond

In October 2022, Subcity services expanded to Ohio, home to 17,000 manufacturers. In the future, Subcity plans to expand to other states with large manufacturing populations, with New York, Illinois, Texas, and Florida as likely next candidates.

“We want to give everyone access to these programs, not just large corporations with a team of tax attorneys and legal experts,” White says. “We want every small manufacturer to feel like they have that Fortune 500 team of experts helping them take advantage of these programs.”

Learn more at Subcity.com.