Economic reports and data signal a continuing decline in manufacturing markets into 2020 for most nations, including the United States. However, the U.S. decline has not been as deep and shouldn’t outlast the downturns in key trading partners’ markets.

Economic reports and data signal a continuing decline in manufacturing markets into 2020 for most nations, including the United States. However, the U.S. decline has not been as deep and shouldn’t outlast the downturns in key trading partners’ markets.

Oxford Economics’ outlook for the Chinese market suggests that final numbers for 2019 will paint lower growth rates in GDP, fixed investment, and manufacturing value-added. This is an untenable situation for China and is one reason they have stepped up talks with the United States to end the bilateral trade war. This will certainly help reinvigorate the Chinese manufacturing sector, and U.S. investors believe it will do the same based on the run up in the U.S. stock exchanges in mid-December. Time will tell, but many analysts believe that China’s economic health will suffer longer term effects. Economic growth rates were already under duress before the trade war as government-owned manufacturers’ heavy debt continues to climb, tensions in Hong Kong create political challenges, and the workforce begins an unstoppable decline. Analysts suggest growth rates will fall over the next three years to nearly 5 percent, creating a need for significant rebalancing of state-owned companies’ debt while reinvigorating growth in consumer demand, which has slowed by nearly 50 percent in the past 10 years.

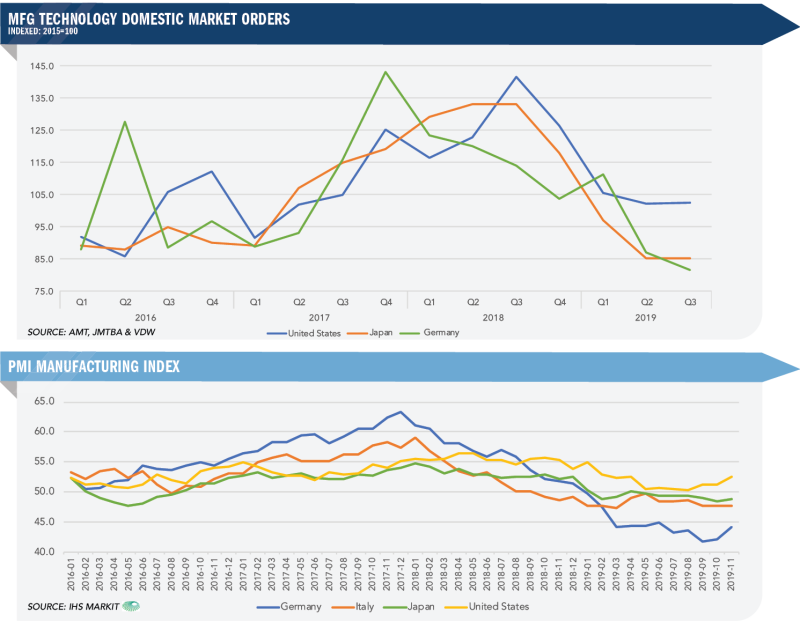

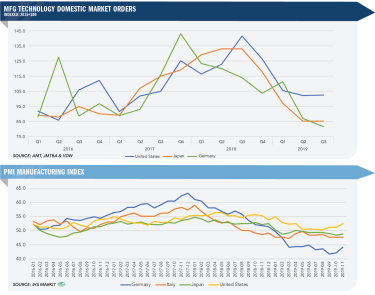

Europe doesn’t have the infrastructure issues China has, but it does face an increasing rate of decline in the manufacturing sector that is overpowering modest gains in the service sector. Chris Williamson, chief business economist for IHS Markit, tweeted in mid-December that the “malaise was led by the sharpest fall in manufacturing output for over 7 years, down for the 11th straight month. Manufacturers cut jobs at increased rate in face of falling demand, culling headcounts to greatest extent since October 2012.” The graphic on the PMI for manufacturing shows Germany’s and Japan’s indices fell below the expansion level of 50 in January 2019 while the United States continued to expand until July. Economists project that Germany’s and Japan’s manufacturing sectors will rebound by the second quarter. This assumes that the United States and EU do not escalate trade issues surrounding aerospace subsidies or other potential flash points for an EU-U.S. trade war.

Considering the challenges our major trading partners are experiencing, the U.S. manufacturing sector is looking good, though durable goods orders have leveled off and manufacturing technology orders are down 15-20 percent from a very strong 2018 figure. U.S. manufacturing technology orders peaked in the third quarter of 2018, while Germany peaked in the fourth quarter of 2017, and Japan’s peaked in the second quarter of 2018. All three markets are expected to see turnarounds in 2020, although Germany and the United States are expected to start before summer. Though the U.S. manufacturing technology market might have seemed a bit depressing in 2019, it wasn’t all that bad.

E-MOBILITY’S IMPACT ON MANUFACTURING TECHNOLOGY ORDERS

One of the most common questions today is when and how much of an impact will the growth of electric vehicles have on our industry. Oxford Economics has just completed a white paper that addresses these two questions on a global basis with a deeper dive into the U.S. market. The conclusion is that e-mobility will have a negative but not catastrophic impact. The impact will be the greatest on the Chinese manufacturing technology sector while the United States falls fairly close to the middle of the nations listed. If you would like a copy of the paper, visit https://bit.ly/2QE4VXF.